Question: Leanne is aged 58 and recently retired from her position as a school teacher and has come to you seeking your advice. She wishes to

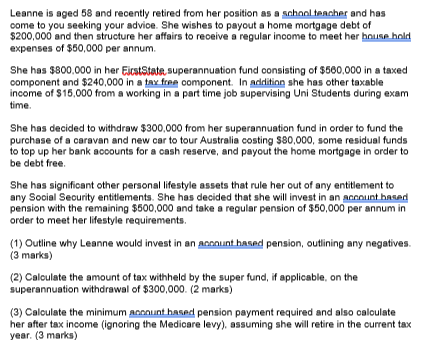

Leanne is aged 58 and recently retired from her position as a school teacher and has come to you seeking your advice. She wishes to payout a home mortgage debt of $200,000 and then structure her affairs to receive a regular income to meet her household expenses of $50,000 per annum. She has $800,000 in her EicstState superannuation fund consisting of $500,000 in a taxed component and $240,000 in a tax free component. In addition she has other taxable income of $15,000 from a working in a part time job supervising Uni Students during exam time She has decided to withdraw $300,000 from her superannuation fund in order to fund the purchase of a caravan and new car to tour Australia costing $80,000, some residual funds to top up her bank accounts for a cash reserve, and payout the home mortgage in order to be debt free She has significant other personal lifestyle assets that rule her out of any entitlement to any Social Security entitlements. She has decided that she will invest in an account based pension with the remaining $500,000 and take a regular pension of $50,000 per annum in order to meet her lifestyle requirements. (1) Outline why Leanne would invest in an arcount based pension, outlining any negatives (3 marks) (2) Calculate the amount of tax withheld by the super fund, if applicable, on the superannuation withdrawal of $300,000. (2 marks) (3) Calculate the minimum Anunt hased pension payment required and also calculate her after tax income (ignoring the Medicare levy), assuming she will retire in the current tax year. (3 marks) Leanne is aged 58 and recently retired from her position as a school teacher and has come to you seeking your advice. She wishes to payout a home mortgage debt of $200,000 and then structure her affairs to receive a regular income to meet her household expenses of $50,000 per annum. She has $800,000 in her EicstState superannuation fund consisting of $500,000 in a taxed component and $240,000 in a tax free component. In addition she has other taxable income of $15,000 from a working in a part time job supervising Uni Students during exam time She has decided to withdraw $300,000 from her superannuation fund in order to fund the purchase of a caravan and new car to tour Australia costing $80,000, some residual funds to top up her bank accounts for a cash reserve, and payout the home mortgage in order to be debt free She has significant other personal lifestyle assets that rule her out of any entitlement to any Social Security entitlements. She has decided that she will invest in an account based pension with the remaining $500,000 and take a regular pension of $50,000 per annum in order to meet her lifestyle requirements. (1) Outline why Leanne would invest in an arcount based pension, outlining any negatives (3 marks) (2) Calculate the amount of tax withheld by the super fund, if applicable, on the superannuation withdrawal of $300,000. (2 marks) (3) Calculate the minimum Anunt hased pension payment required and also calculate her after tax income (ignoring the Medicare levy), assuming she will retire in the current tax year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts