Question: LEARLY GAI : +42 w eac Question #1: Canon Limited [13 Marks] (19 Minutes) Part A Canon Limited had an $800 credit balance in Allowance

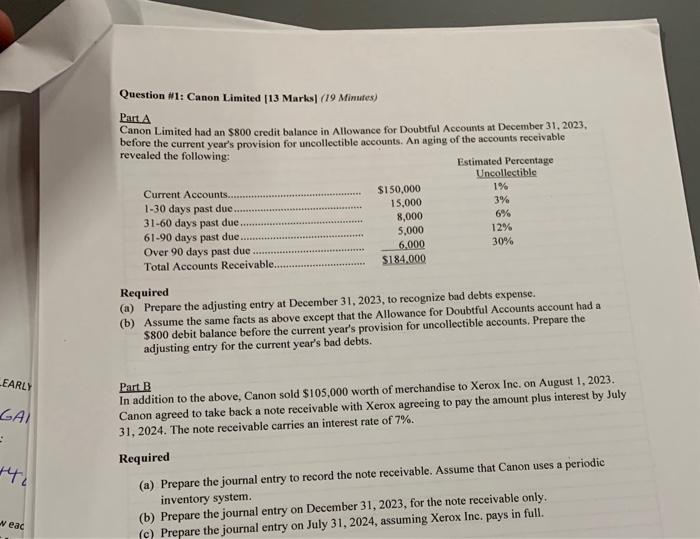

Question \#1: Canon Limited [13 Marks] ( 19 Minutes) Part A Canon Limited had an $800 credit balance in Allowance for Doubtful Accounts at December 31, 2023 , before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the fallawina: Required (a) Prepare the adjusting entry at December 31, 2023, to recognize bad debts expense. (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $800 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's bad debts. Part B In addition to the above, Canon sold $105,000 worth of merchandise to Xerox Inc. on August 1, 2023. Canon agreed to take back a note receivable with Xerox agreeing to pay the amount plus interest by July 31,2024 . The note receivable carries an interest rate of 7%. Required (a) Prepare the journal entry to record the note receivable. Assume that Canon uses a periodic inventory system. (b) Prepare the journal entry on December 31, 2023, for the note receivable only. (c) Prepare the journal entry on July 31,2024 , assuming Xerox Inc. pays in full

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts