Question: Learning Activity 3 - based on Unit 7 1. A 30 year Treasury Bond is issues with par value of $1,000, paying interest of $80

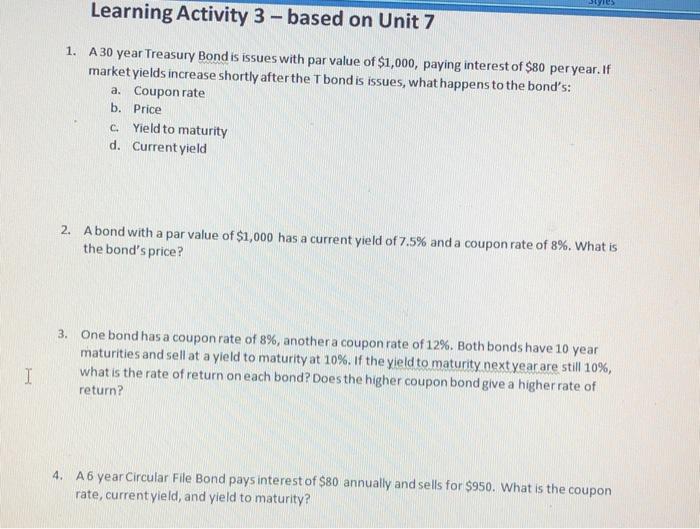

Learning Activity 3 - based on Unit 7 1. A 30 year Treasury Bond is issues with par value of $1,000, paying interest of $80 peryear. If market yields increase shortly after the Tbond is issues, what happens to the bond's: a. Coupon rate b. Price Yield to maturity d. Current yield C. 2. Abond with a par value of $1,000 has a current yield of 7.5% and a coupon rate of 8%. What is the bond's price? 3. One bond has a coupon rate of 8%, another a coupon rate of 12%. Both bonds have 10 year maturities and sell at a yield to maturity at 10%. If the yield to maturity next year are still 10%, what is the rate of return on each bond? Does the higher coupon bond give a higher rate of return? I 4. A6 year Circular File Bond pays interest of $80 annually and sells for $950. What is the coupon rate, current yield, and yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts