Question: Learning Objective 04-P2 : Prepare closing entries and a post-closing trial balance. Explain why temporary accounts are closed each period. Temporary accounts are closed at

Learning Objective 04-P2: Prepare closing entries and a post-closing trial balance.

Explain why temporary accounts are closed each period. Temporary accounts are closed at the end of each accounting period for two main reasons. First, the closing process updates the capital account to include the effects of all transactions and events recorded for the period. Second, it prepares revenue, expense, and withdrawals accounts for the next reporting period by giving them zero balances.

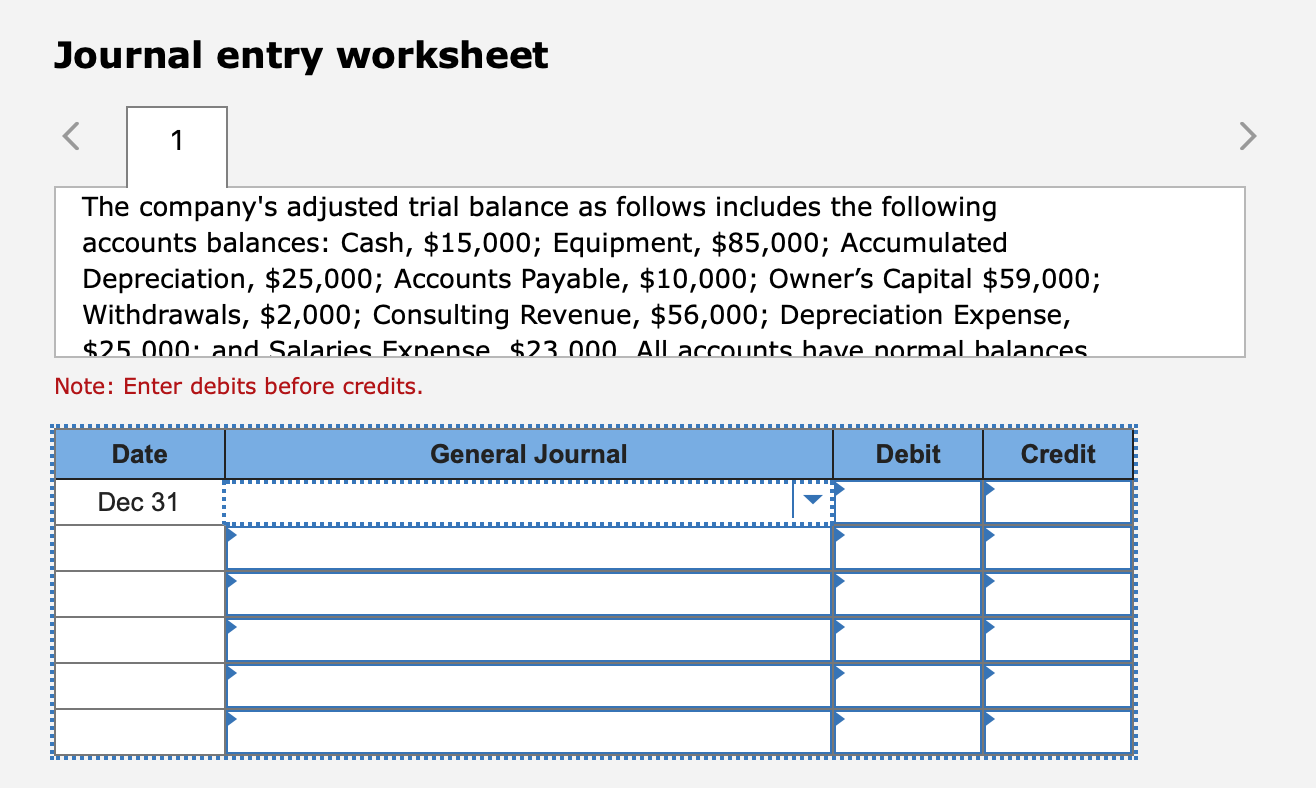

Knowledge Check 01 The company's adjusted trial balance as follows includes the following accounts balances: Cash, $15,000; Equipment, $85,000; Accumulated Depreciation, $25,000; Accounts Payable, $10,000; Owners Capital $59,000; Withdrawals, $2,000; Consulting Revenue, $56,000; Depreciation Expense, $25,000; and Salaries Expense, $23,000. All accounts have normal balances. Prepare the first closing entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

Journal entry worksheet 1 The company's adjusted trial balance as follows includes the following accounts balances: Cash, $15,000; Equipment, $85,000; Accumulated Depreciation, $25,000; Accounts Payable, $10,000; Owner's Capital $59,000; Withdrawals, $2,000; Consulting Revenue, $56,000; Depreciation Expense, $25.000 and Salaries Expense $23.000 All accounts have normal balances. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts