Question: Learning Objective 3 Journalizing adjusting entries and subsequent journal entries Lopez Landscaping has the following data for the December 31 adjusting entries: P3-39B a. Each

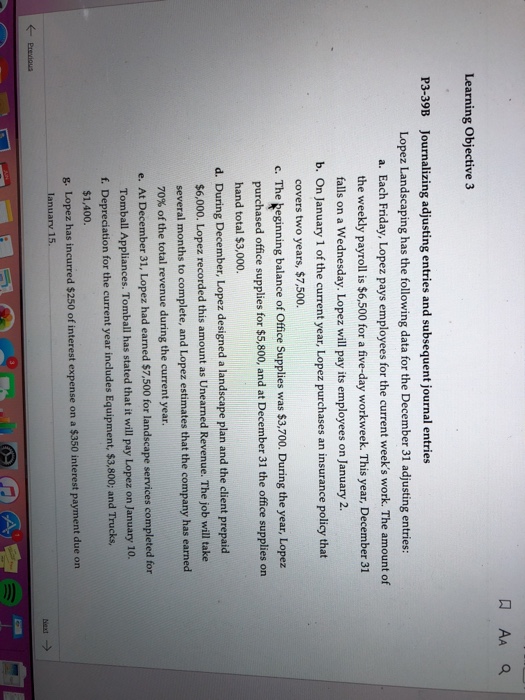

Learning Objective 3 Journalizing adjusting entries and subsequent journal entries Lopez Landscaping has the following data for the December 31 adjusting entries: P3-39B a. Each Friday, Lopez pays employees for the current week's work. The amount of the weekly payroll is $6,500 for a five-day workweek. This year, December 31 falls on a Wednesday. Lopez will pay its employees on January 2 covers two years, $7,500. purchased office supplies for $5,800, and at December 31 the office supplies on b. On January 1 of the current year, Lopez purchases an insurance policy that c. The keginning balance of Office Supplies was $3,700. During the year, Lopez hand total $3,000. d. During December, Lopez designed a landscape plan and the client prepaid $6,000. Lopez recorded this amount as Unearned Revenue. The job will take several months to complete, and Lopez estimates that the company has earned 70% of the total revenue during the current year. e. At December 31, Lopez had earned $7,500 for landscape services completed for f. Depreciation for the current year includes Equipment, $3,800; and Trucks, & Lopez has incurred $250 of interest expense on a $350 interest payment due on Tomball Appliances. Tomball has stated that it will pay Lopez on January 10. $1,400. lanuarv 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts