Question: (Learning Objective 4: Applying the allowance method to account for uncollectibles) Gray and Dumham, a law firm, started 20X6 with accounts receivable of $31,000 and

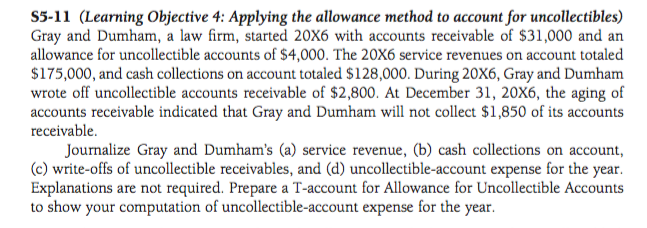

(Learning Objective 4: Applying the allowance method to account for uncollectibles) Gray and Dumham, a law firm, started 20X6 with accounts receivable of $31,000 and an allowance for uncollectible accounts of $4,000. The 20X6 service revenues on account totaled $175,000, and cash collections on account totaled $128,000. During 20X6, Gray and Dumham wrote off uncollectible accounts receivable of $2,800. At December 31, 20X6, the aging of accounts receivable indicated that Gray and Dumham will not collect $1,850 of its accounts receivable. Journalize Gray and Dumham's (a) service revenue, (b) cash collections on account, (c) write-offs of uncollectible receivables, and (d) uncollectible-account expense for the year. Explanations are not required. Prepare a T-account for Allowance for Uncollectible Accounts to show your computation of uncollectible-account expense for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts