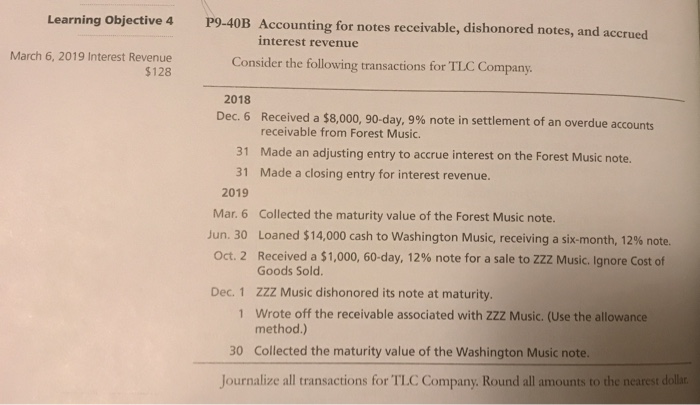

Question: Learning Objective 4 P9-40B Accounting for notes receivable, dishonored notes, and accrued interest revenue March 6, 2019 Interest Revenue $128 Consider the following transactions for

Learning Objective 4 P9-40B Accounting for notes receivable, dishonored notes, and accrued interest revenue March 6, 2019 Interest Revenue $128 Consider the following transactions for TLC Company 2018 Dec. 6 Received a $8,000, 90-day, 9% note in settlement of an overdue accounts receivable from Forest Music. Made an adjusting entry to accrue interest on the Forest Music note. 31 31 Made a closing entry for interest revenue. 2019 Mar. 6 Collected the maturity value of the Forest Music note. Jun. 30 Loaned $14,000 cash to Washington Music, receiving a six-month, 12 % note Oct. 2 Received a $1,000, 60-day, 12% note for a sale to ZZZ Music. Ignore Cost of Goods Sold. ZZZ Music dishonored its note at maturity. Wrote off the receivable associated with ZZZ Music. (Use the allowance Dec. 1 1 method.) Collected the maturity value of the Washington Music note. 30 Journalize all transactions for TLC Company. Round all amounts to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts