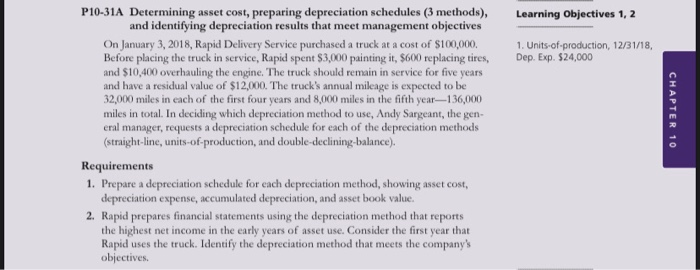

Question: Learning Objectives 1, 2 1. Units-of-production, 12/31/18, Dep. Exp. $24,000 P10-31A Determining asset cost, preparing depreciation schedules (3 methods), and identifying depreciation results that meet

Learning Objectives 1, 2 1. Units-of-production, 12/31/18, Dep. Exp. $24,000 P10-31A Determining asset cost, preparing depreciation schedules (3 methods), and identifying depreciation results that meet management objectives On January 3, 2018, Rapid Delivery Service purchased a truck at a cost of $100,000. Before placing the truck in service, Rapid spent $3,000 painting it, $600 replacing tires, and $10,400 overhauling the engine. The truck should remain in service for five years and have a residual value of $12,000. The truck's annual mileage is expected to be 32,000 miles in each of the first four years and 8,000 miles in the fifth year-136,000 miles in total. In deciding which depreciation method to use, Andy Sargeant, the gen- eral manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance). CHAPTER 10 Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. Rapid prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Rapid uses the truck. Identify the depreciation method that meets the company's objectives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts