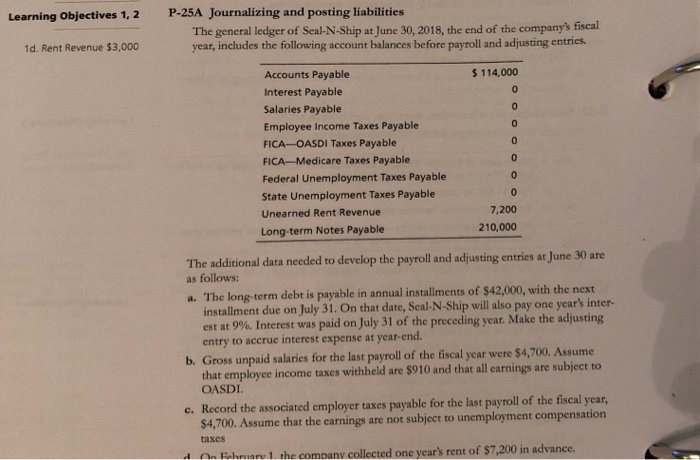

Question: Learning Objectives 1, 2 P-25A Journalizing and posting liabilities The general ledger of Seal-N-Ship at June 30, 2018, the end of the company's fiscal year,

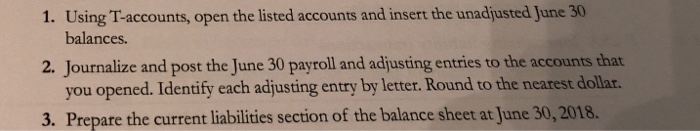

Learning Objectives 1, 2 P-25A Journalizing and posting liabilities The general ledger of Seal-N-Ship at June 30, 2018, the end of the company's fiscal year, includes the following account balances before payroll and adjusting entries 1d. Rent Revenue $3,000 114,000 0 Accounts Payable Interest Payable Salaries Payable Employee Income Taxes Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Unearned Rent Revenue Long-term Notes Payable 7,200 210,000 The additional data needed to develop the payroll and adjusting entries at June 30 are as follows: a. The long- term debt is payable in annual installments of $42,000, with the next installment due on July 31. On that date, Seal-N-Ship will also pay one years inter est at 9%. Interest was paid on July 31 of the preceding year. Make the adjusting entry to accrue interest expense at year-end. b. Gross unpaid salaries for the last payroll of the fiscal year were $4,700. Assume that employee income taxes withheld are $910 and that all earnings are subject to OASDI c. Record the associated employer taxes payable for the last payroll of the fiscal year, $4,700. Assume that the earnings are not subject to unemployment compensation taxes Fohnary 1 the companv collected one year's rent of $7,200 in advance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts