Question: Learning Objectives 1. Prepare common size Income Statement in Excel 2. Prepare common size Balance Sheet in Excel 3. Use appropriate formulas and cell referencing

Learning Objectives 1. Prepare common size Income Statement in Excel 2. Prepare common size Balance Sheet in Excel 3. Use appropriate formulas and cell referencing to create common size financial statements 4. Apply appropriate numeric format on Excel spread 5. Analyze and interpret outcome of financial statement ratios.

Data Set Background

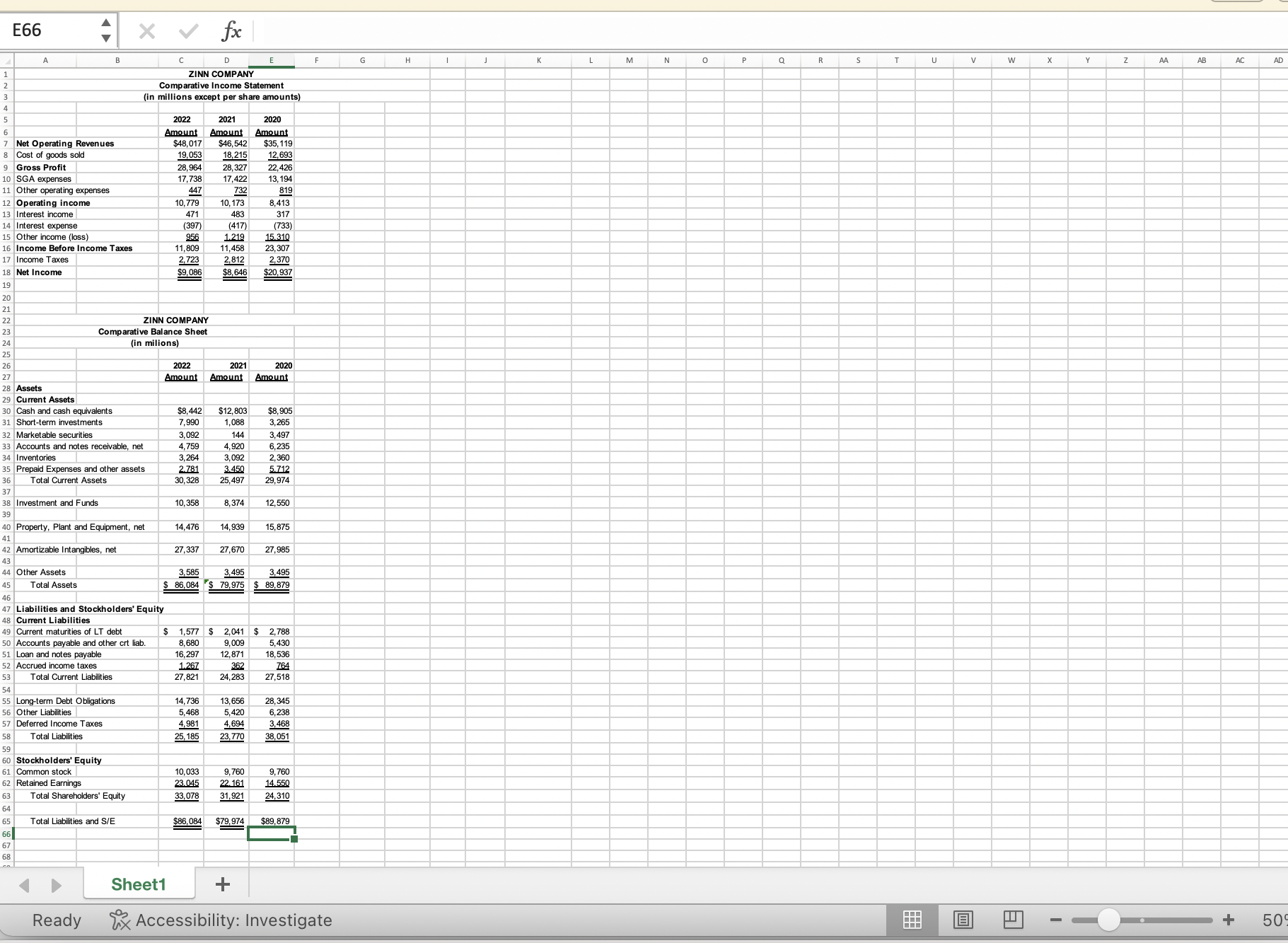

As an analyst you are asked to conduct a financial statement analysis and risk analysis of a company. The data set contains the Income Statement and Balance Sheet of Zinn, Inc. for years 2020 through 2022.

Required:

1. Prepare a common size Income Statement and common size Balance Sheet for the years 2022 and 2021on a separate worksheet. Label the worksheet 'ComSizeFS'. You should apply appropriate formulas for the percentages, subtotals, and totals with the proper cell referencing. Percentages should be rounded to 2 decimal places.

2. Calculate the following financial statement ratios for the years 2022 and 2021 on a separate worksheet. Label the worksheet 'FinStRatios'. You should apply appropriate formulas to calculate the ratios with the proper cell referencing. Ratios and percentages should be rounded to 2 decimal places. The financial statement ratios to be calculated are:

a. Liquidity Ratios - Current ratio and Quick ratio (see Chapter 3)

b. Solvency Ratios - Debt to equity and Times interest earned

c. Activity Ratios - Asset turnover, Receivables turnover, and Inventory turnover

d. Profitability Ratios - Profit margin on sales, Return on assets, and Return on equity

e. Leverage Ratio - Equity multiplier

3. Based on your financial statement analysis, what trends do note from 2021 to 2022 and what does this suggest about the company's liquidity, profitability, and solvency? Place your summation in the row below the financial statement ratios on the FinStRatios worksheet.

4. Format worksheet with font style Times New Roman, font size 12, and appropriate numeric formatting.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts