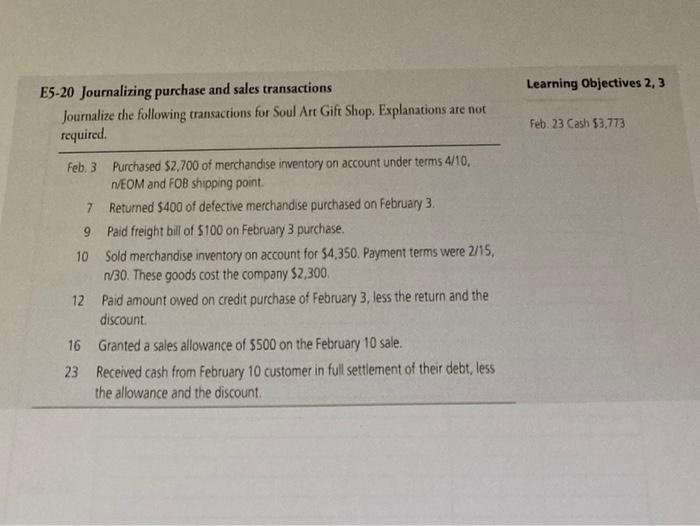

Question: Learning Objectives 2, 3 E5-20 Journalizing purchase and sales transactions Joumalize the following transactions for Soul Art Gift Shop, Explanations are not required Feb. 23

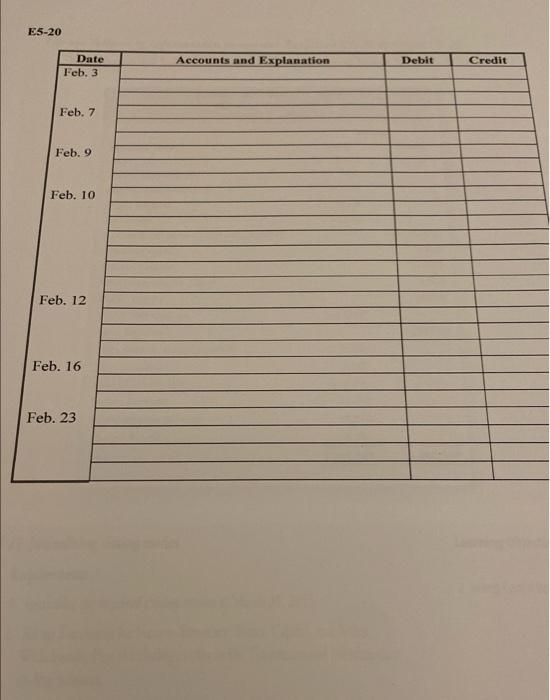

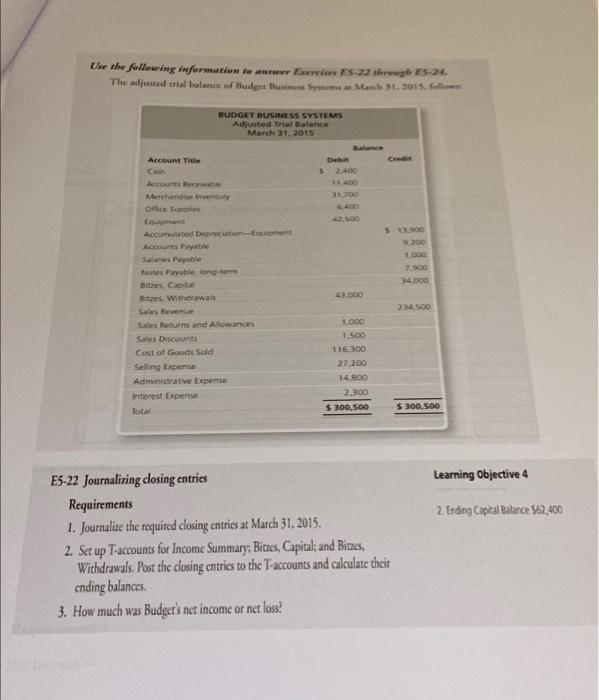

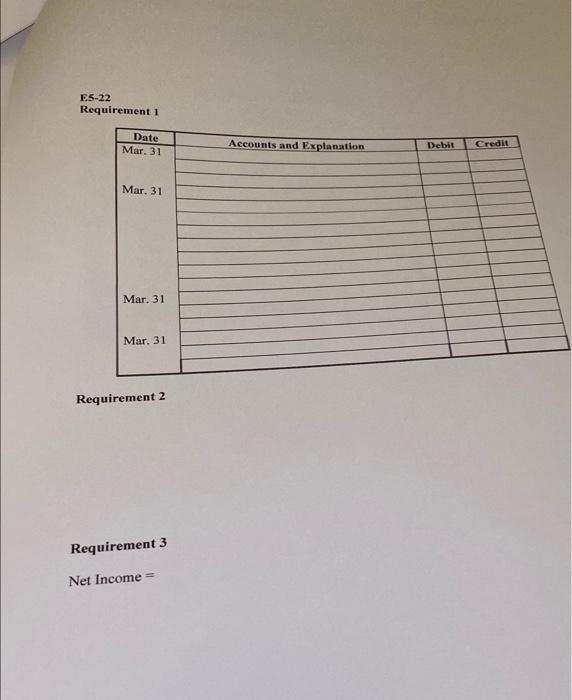

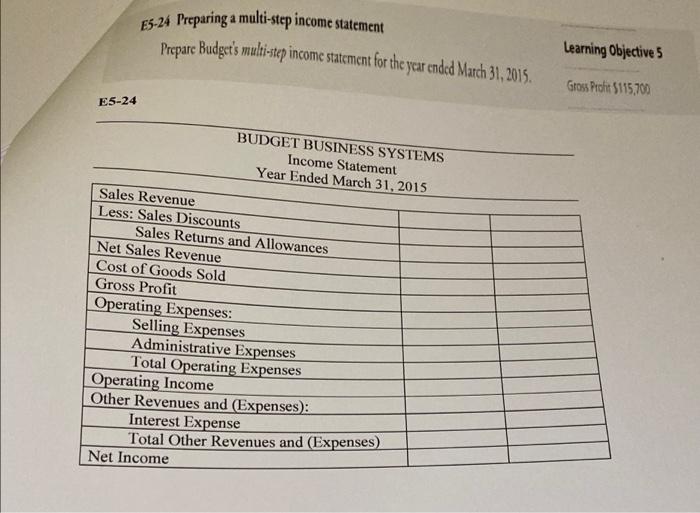

Learning Objectives 2, 3 E5-20 Journalizing purchase and sales transactions Joumalize the following transactions for Soul Art Gift Shop, Explanations are not required Feb. 23 Cash 53.773 Feb. 3 Purchased $2,700 of merchandise inventory on account under terms 4/10, NEOM and FOB shipping point. 7 Returned $400 of defective merchandise purchased on February 3. 9 Paid freight bill of $100 on February 3 purchase. 10 Sold merchandise inventory on account for 54,350. Payment terms were 2/15, n30. These goods cost the company $2,300 12 Paid amount owed on credit purchase of February 3, less the return and the discount 16 Granted a sales allowance of $500 on the February 10 sale. 23 Received cash from February 10 customer in full settlement of their debt, less the allowance and the discount. E5-20 Date Feb. 3 Accounts and Explanation Debit Credit Feb. 7 Feb. 9 Feb. 10 Feb. 12 Feb. 16 Feb. 23 Use the following information to ar E5-22wgh E5-24. The adjusted trial balance of Budget Business Systems at March 31, 2015. follow BUDGET BUSINESS SYSTEMS Adjusted Trial Balance March 31, 2015 C Debe 2.400 11.400 1.700 6.100 . 9.200 200 34 000 Account Title C Account Merchandise Office Supos Equat Accumulated Depreciation Equipment Accounts Payable Saares Payable Notes Payable org term Bite Capital Bar Withdrawals Sales Revenue Sales Returns and Allowances Sales Discounts Cost of Goods Sold Selling Expense Admistrative Expense Interest Expense Total 43,000 234 500 1.000 1.500 116,300 27,200 14.800 2.300 $ 300,500 5 300, 500 Learning Objective 4 2 Ending Capital Balance 562,400 E5-22 Journaliring closing entries Requirements 1. Journalize the required closing entries at March 31, 2015. 2. Ser up T-accounts for Income Summary, Bitres, Capital and Bitzes, Withdrawals. Post the closing entries to the T-accounts and calculate their cnding balances 3. How much was Budget's net income or net loss? E5-22 Requirement1 Date Mar. 31 Accounts and Explanation Debit Credit Mar. 31 Mar. 31 Mar. 31 Requirement 2 Requirement 3 Net Income E5-24 Preparing a multi-step income statement Prepare Budget's multi-step income statement for the year ended Match 31, 2015. Learning Objectives Gross Prot 5115,700 E5-24 BUDGET BUSINESS SYSTEMS Income Statement Year Ended March 31, 2015 Sales Revenue Less: Sales Discounts Sales Returns and Allowances Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Selling Expenses Administrative Expenses Total Operating Expenses Operating Income Other Revenues and (Expenses): Interest Expense Total Other Revenues and (Expenses) Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts