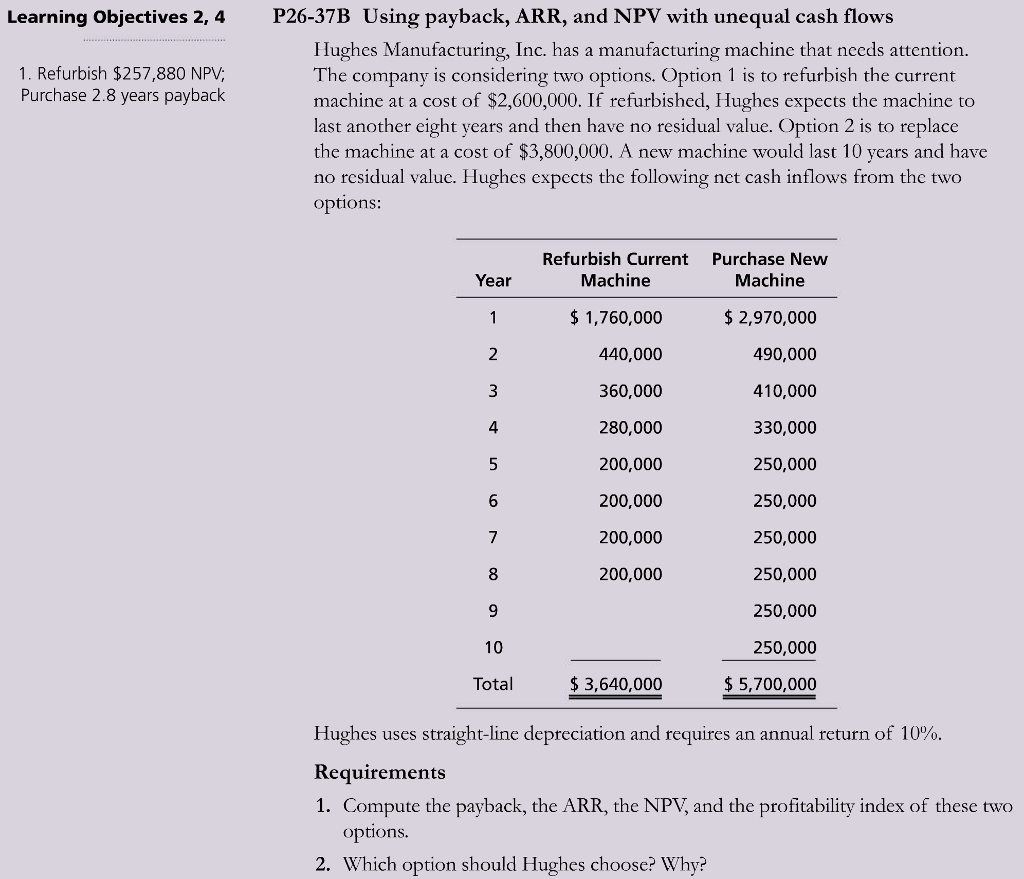

Question: Learning Objectives 2, 4 P26-37B Using payback, ARR, and NPV with unequal cash flows Hughes Manufacturing, Inc. has a manufacturing machine that needs attention 1.

Learning Objectives 2, 4 P26-37B Using payback, ARR, and NPV with unequal cash flows Hughes Manufacturing, Inc. has a manufacturing machine that needs attention 1. Refurbish $257,880 NPV Purchase 2.8 years payback e company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,600,000. If refurbished, Hughes expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $3,800,000. A new machine would last 10 years and have no residual valuc. Hughes expects the following net cash inflows from the two options: Refurbish Current Machine Purchase New Machine Year $ 1,760,000 440,000 360,000 280,000 200,000 200,000 200,000 200,000 $2,970,000 490,000 410,000 330,000 250,000 250,000 250,000 250,000 250,000 250,000 $ 5,700,000 4 8 Total 3,640,000 Hughes uses straight-line depreciation and requires an annual return of 10%. Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options 2. Which option should Hughes choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts