Question: Learning Objectives - Identify what a capital budgeting project is, provide an example. - Estimate the NPV and IRR in a project and give reason

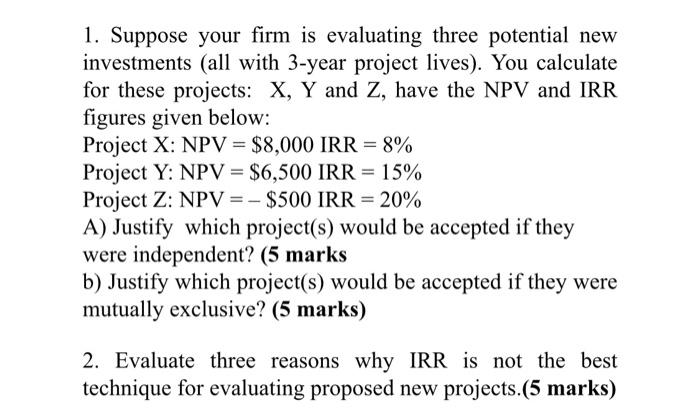

Learning Objectives - Identify what a capital budgeting project is, provide an example. - Estimate the NPV and IRR in a project and give reason why the capital budgeting process is essential to maximizing shareholder wealth - Evaluate the difference between independent and mutually exclusive projects - Apply the relevance of the four key capital budgeting criteria 1. Suppose your firm is evaluating three potential new investments (all with 3-year project lives). You calculate for these projects: X,Y and Z, have the NPV and IRR figures given below: Project X: NPV =$8,000 IRR =8% Project Y: NPV =$6,500IRR=15% Project Z: NPV =$500 IRR =20% A) Justify which project(s) would be accepted if they were independent? (5 marks b) Justify which project(s) would be accepted if they were mutually exclusive? (5 marks) 2. Evaluate three reasons why IRR is not the best technique for evaluating proposed new projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts