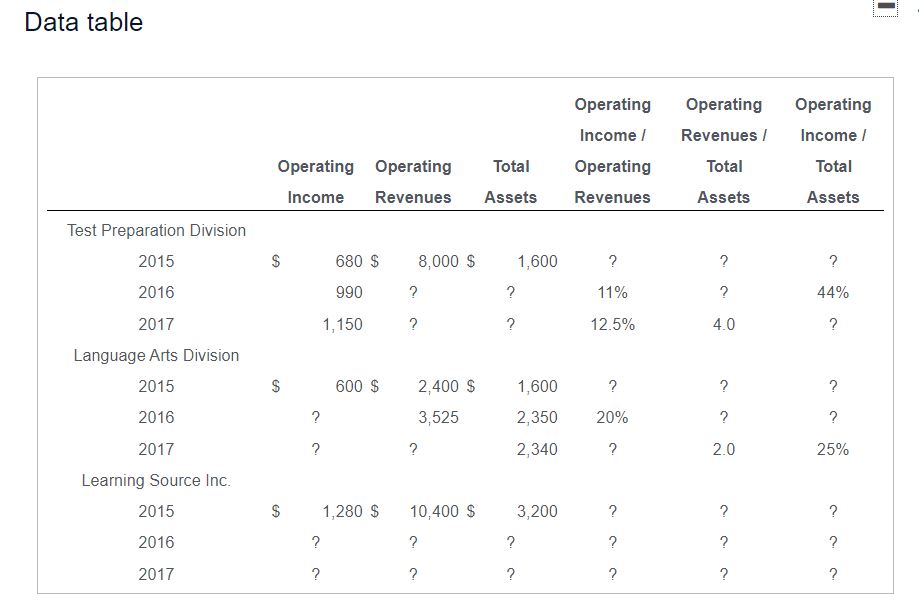

Question: Learning Source, Inc. has two divisions: Test Preparation and Language Arts. Results (in millions) for the past three years are partially displayed here: (Click

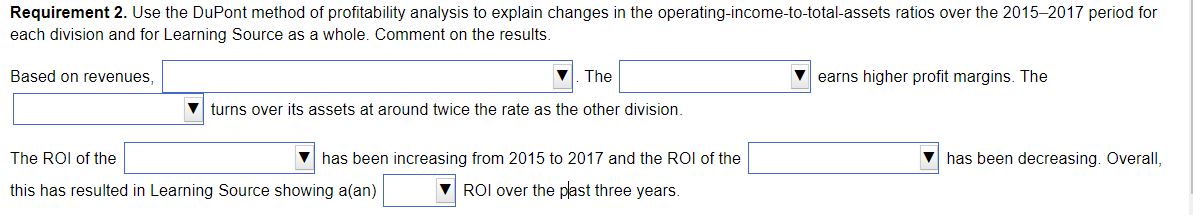

Learning Source, Inc. has two divisions: Test Preparation and Language Arts. Results (in millions) for the past three years are partially displayed here: (Click the icon to view the results.) Requirements 1. Complete the table by filling in the blanks. 2. Use the DuPont method of profitability analysis to explain changes in the operating-income-to-total-assets ratios over the 2015-2017 period for each division and for Learning Source as a whole. Comment on the results. Requirement 1. Complete the table by filling in the blanks. (Round all dollar amounts to the nearest dollar, percentages to the nearest tenth percent, XX%, and ratios to one decimal place.) Operating Income Operating Revenues Total Assets Operating Income/ Operating Revenues Operating Operating Revenues / Income/ Total Total Assets Assets Test Preparation Division 2015 $ 680 $ 8,000 $ 1,600 % % 2016 990 11 % 44 % 2017 1,150 12.5% 4.0 % Language Arts Dept. 2015 2016 2017 Learning Source Inc. 2015 2016 2017 $ 600 $ 2,400 $ 1,600 % % 3,525 2,350 20% % 2,340 % 2.0 25 % $ 1,280 $ 10,400 $ 3,200 % % % % % % Data table Operating Operating Operating Income/ Revenues/ Income/ Operating Operating Total Operating Total Total Income Revenues Assets Revenues Assets Assets Test Preparation Division 2015 $ 680 $ 8,000 $ 1,600 ? ? ? 2016 990 ? ? 11% ? 44% 2017 1,150 ? ? 12.5% 4.0 ? Language Arts Division 2015 2016 2017 Learning Source Inc. 2015 2016 2017 $ 600 $ 2,400 $ 1,600 ? ? ? ? 3,525 2,350 20% ? ? ? ? 2,340 ? 2.0 25% $ 1,280 $ 10,400 $ 3,200 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Requirement 2. Use the DuPont method of profitability analysis to explain changes in the operating-income-to-total-assets ratios over the 2015-2017 period for each division and for Learning Source as a whole. Comment on the results. Based on revenues, The turns over its assets at around twice the rate as the other division. The ROI of the this has resulted in Learning Source showing a(an) has been increasing from 2015 to 2017 and the ROI of the ROI over the past three years. earns higher profit margins. The has been decreasing. Overall,

Step by Step Solution

There are 3 Steps involved in it

That sounds like an interesting analysis ... View full answer

Get step-by-step solutions from verified subject matter experts