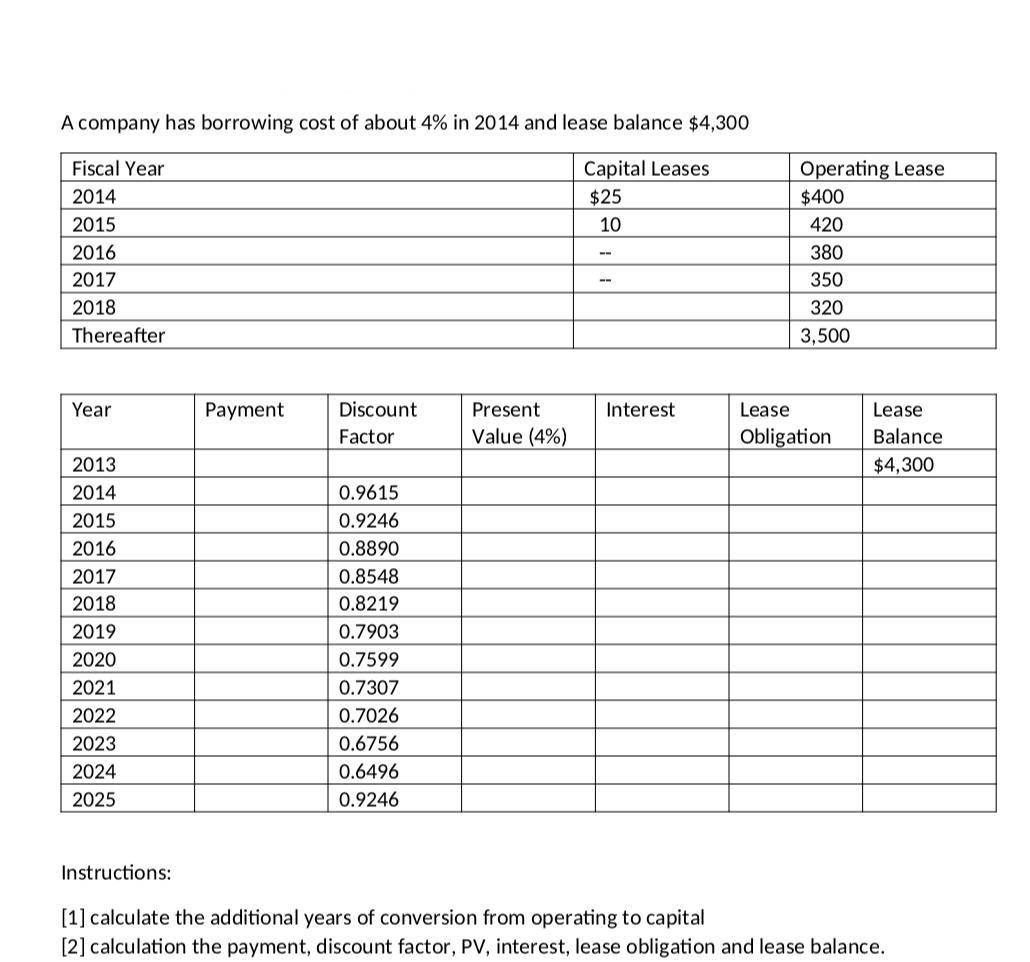

Question: A company has borrowing cost of about 4% in 2014 and lease balance $4,300 Operating Lease $400 Fiscal Year Capital Leases 2014 $25 2015

A company has borrowing cost of about 4% in 2014 and lease balance $4,300 Operating Lease $400 Fiscal Year Capital Leases 2014 $25 2015 10 420 2016 380 -- 2017 350 2018 320 Thereafter 3,500 Year Payment Discount Present Interest Lease Lease Factor Value (4%) Obligation Balance 2013 $4,300 2014 0.9615 2015 0.9246 2016 0.8890 2017 0.8548 2018 0.8219 2019 0.7903 2020 0.7599 2021 0.7307 2022 0.7026 2023 0.6756 2024 0.6496 2025 0.9246 Instructions: [1] calculate the additional years of conversion from operating to capital [2] calculation the payment, discount factor, PV, interest, lease obligation and lease balance.

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Year Payment Dis Factor 4 Present Value 4 Interest Lease Obligation Lease Baalance a b c d b x c e o... View full answer

Get step-by-step solutions from verified subject matter experts