Question: lease outline clear steps how to solve the problems. thank you! 11. The Target Copy Company is contemplating the replacement of its old printing machine

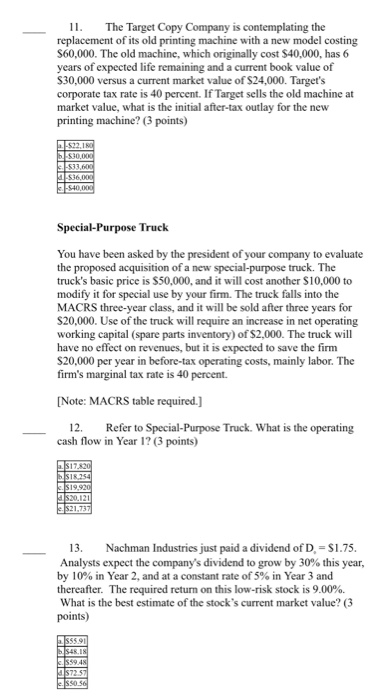

11. The Target Copy Company is contemplating the replacement of its old printing machine with a new model costing $60,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and a current book value of $30,000 versus a current market value of $24,000. Target's corporate tax rate is 40 percent. If Target sells the old machine at market value, what is the initial after-tax outlay for the new printing machine? (3 points) 536,000 Special Purpose Truck You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck. The truck's basic price is $50,000, and it will cost another $10,000 to modify it for special use by your firm. The truck falls into the MACRS three-year class, and it will be sold after three years for $20,000. Use of the truck will require an increase in net operating working capital (spare parts inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 40 percent. [Note: MACRS table required.] 12. Refer to Special-Purpose Truck. What is the operating cash flow in Year 1? (3 points) Ls17820 ISIR 254 $19.920 s20.121 e. $21.737 13. Nachman Industries just paid a dividend of D = $1.75. Analysts expect the company's dividend to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter. The required return on this low-risk stock is 9.00% What is the best estimate of the stock's current market value? (3 points) S5591

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts