Question: Leases Example 6 - Other costs Lessor and Lessee enter into a seven - year lease for a small office building. The contract designates in

Leases

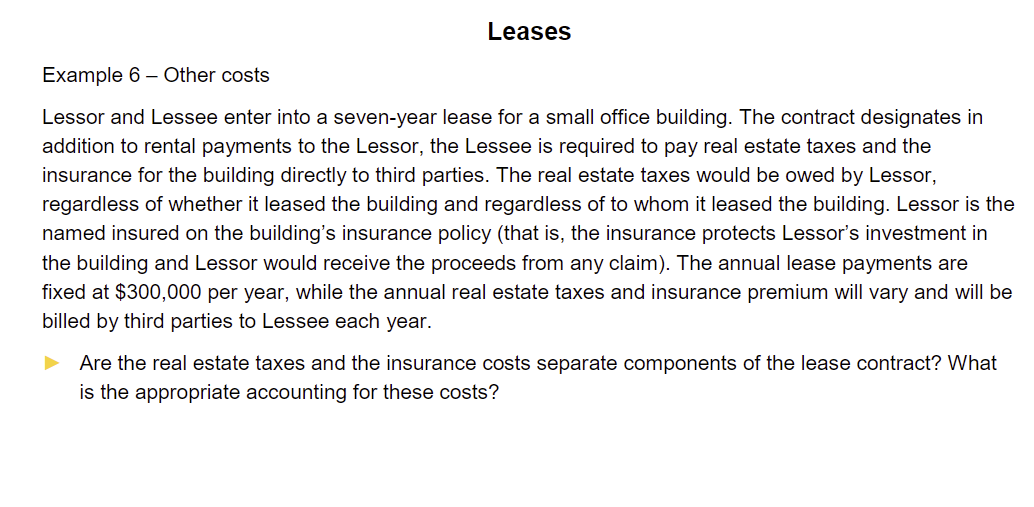

Example Other costs

Lessor and Lessee enter into a sevenyear lease for a small office building. The contract designates in addition to rental payments to the Lessor, the Lessee is required to pay real estate taxes and the insurance for the building directly to third parties. The real estate taxes would be owed by Lessor, regardless of whether it leased the building and regardless of to whom it leased the building. Lessor is the named insured on the building's insurance policy that is the insurance protects Lessor's investment in the building and Lessor would receive the proceeds from any claim The annual lease payments are fixed at $ per year, while the annual real estate taxes and insurance premium will vary and will be billed by third parties to Lessee each year.

Are the real estate taxes and the insurance costs separate components of the lease contract? What is the appropriate accounting for these costs?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock