Question: lech... Chapter #7 - Quiz i Saved Help Save & Exit Submit Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the

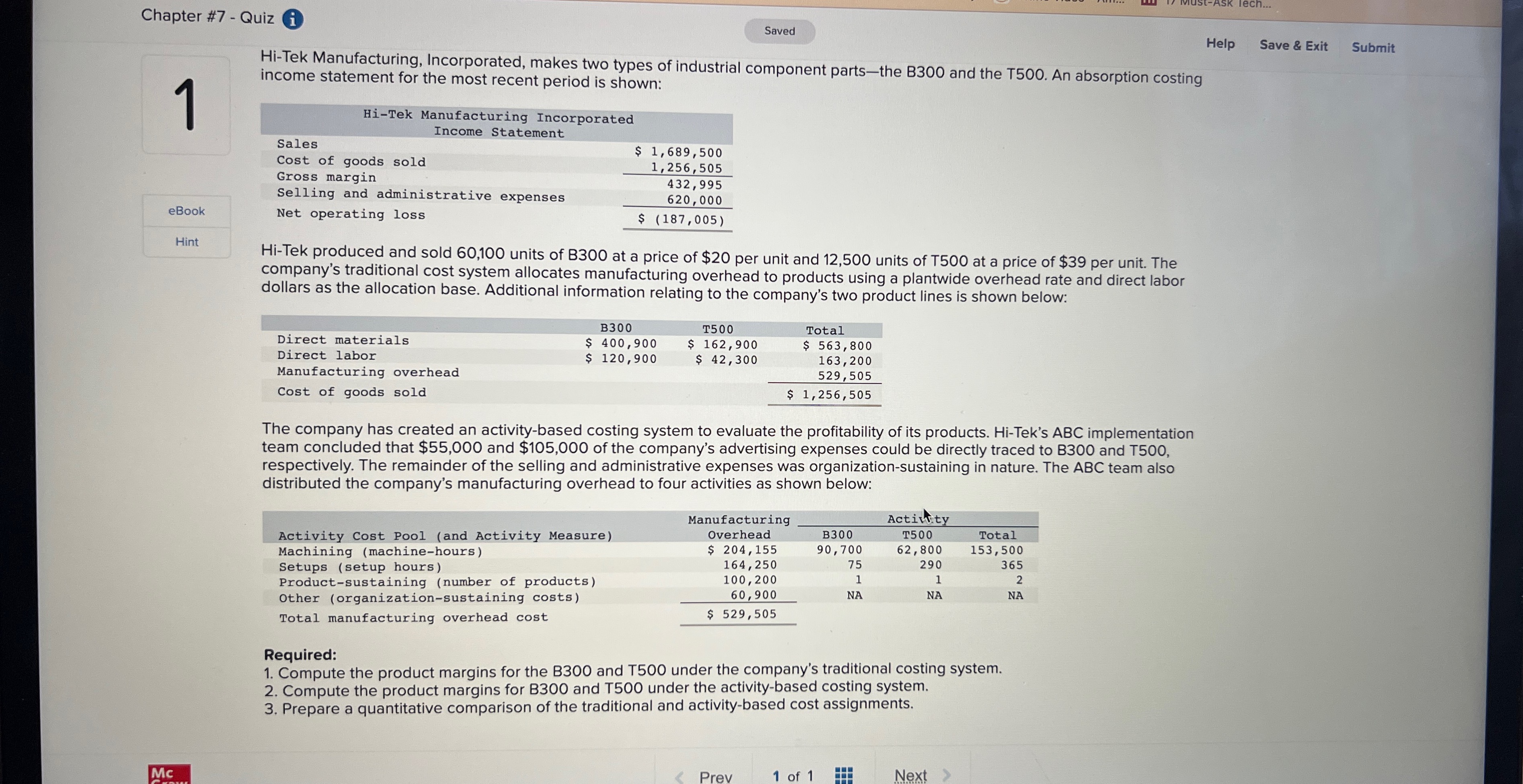

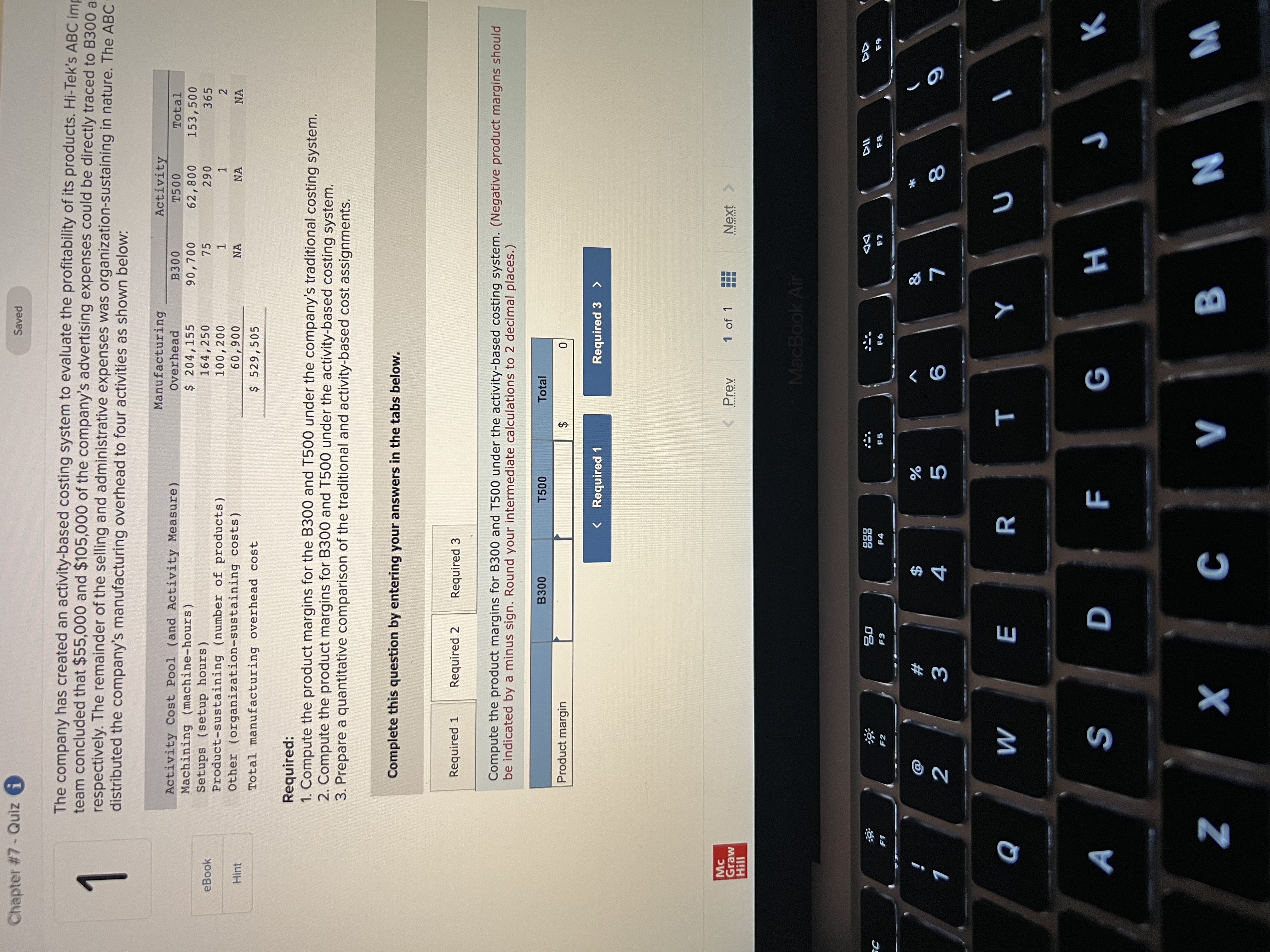

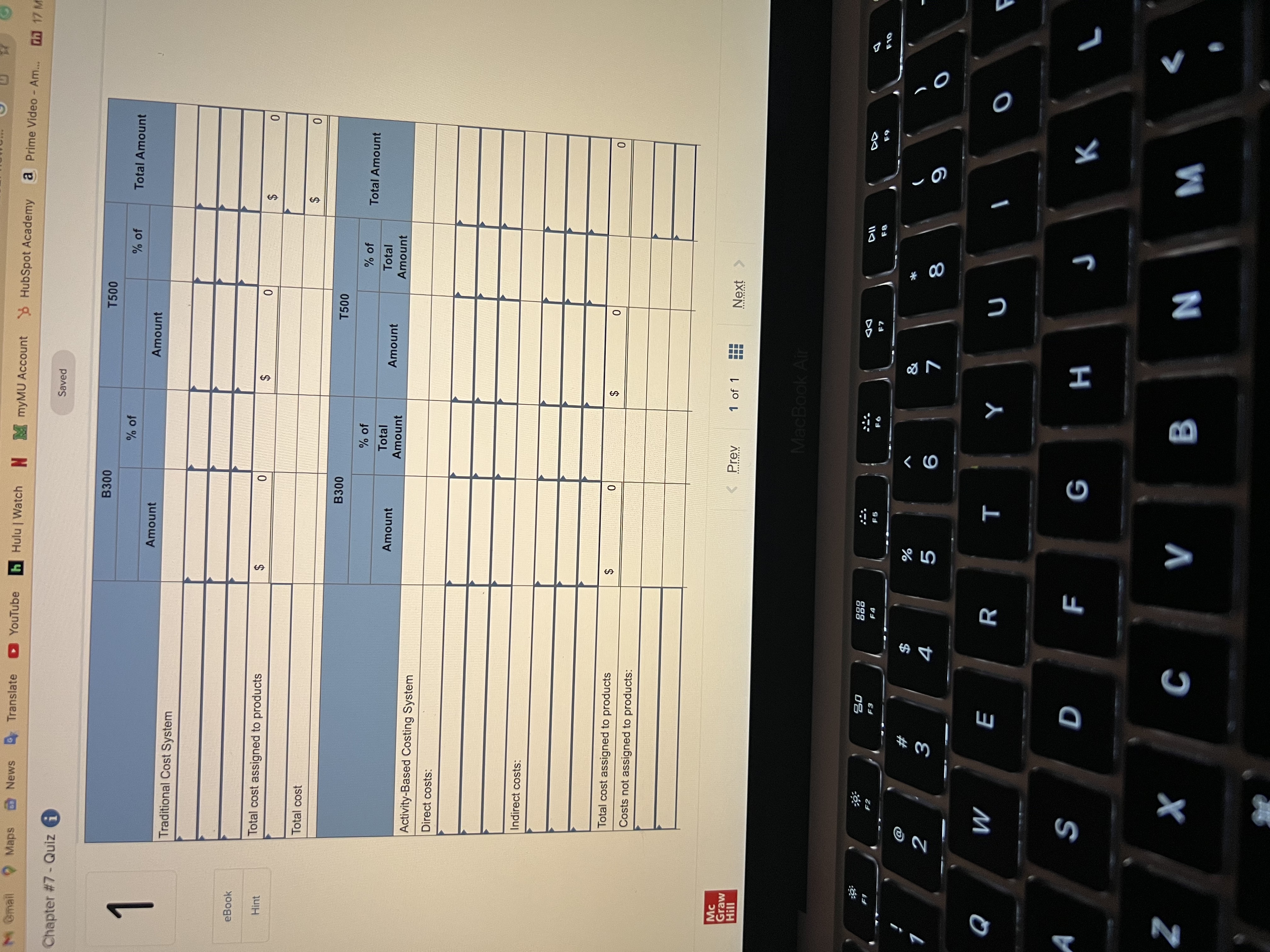

lech... Chapter #7 - Quiz i Saved Help Save & Exit Submit Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Incorporated Income Statement Sales $ 1, 689, 500 Cost of goods sold 1, 256, 505 Gross margin 132, 995 Selling and administrative expenses 520 , 000 eBook Net operating loss $ (187, 005) Hint Hi-Tek produced and sold 60,100 units of B300 at a price of $20 per unit and 12,500 units of T500 at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: B300 T500 Total Direct materials $ 400, 900 $ 162, 900 $ 563, 800 Direct labor $ 120 ,900 $ 42, 300 163, 200 Manufacturing overhead 529, 505 Cost of goods sold $ 1, 256, 505 The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team concluded that $55,000 and $105,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Manufacturing Activity Activity Cost Pool (and Activity Measure) Overhead B300 T500 Total Machining (machine-hours) $ 204, 155 90, 700 52,800 153, 500 Setups ( setup hours) 164, 250 75 290 365 Product-sustaining (number of products) 100, 200 Other (organization-sustaining costs) 60, 900 NA NA NA Total manufacturing overhead cost $ 529, 505 Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Mc of 1 NextChapter #7 - Quiz i Saved The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC im team concluded that $55,000 and $105,000 of the company's advertising expenses could be directly traced to B300 a respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC distributed the company's manufacturing overhead to four activities as shown below: Manufacturing Activity Activity Cost Pool (and Activity Measure) Overhead B300 T500 Total Machining (machine-hours) $ 204 , 155 90 , 700 62, 800 153, 500 290 eBook Setups (setup hours) 164, 250 75 365 Product-sustaining (number of products) 100, 200 Hint Other (organization-sustaining costs) 60, 900 NA NA NA Total manufacturing overhead cost $ 529 , 505 Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the product margins for B300 and T500 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) 3300 T500 Total Product margin $ 0 Mc Hill MacBook Air 20 188 GA F6 @ # $ 3 5 6 8 Q W E R T Y U F G H J K A S D Z X C V B N MM Gmail Maps News Translate YouTube h Hulu | Watch N M myMU Account HubSpot Academy a Prime Video - Am... on 17 Chapter #7 - Quiz i Saved B300 T500 % of % of Total Amount Amount Amount Traditional Cost System eBook Hint Total cost assigned to products $ $ $ Total cost $ B300 T500 % of % of Total Amount Amount Total Total Amount Amount Amount Activity-Based Costing System Direct costs Indirect costs: Total cost assigned to products $ o $ o Costs not assigned to products: Mc Grav Hill Prev 1 of 1 Next MacBook Air 80 888 DD A F1 F3 EA F10 @ N 5 6 Q W E R T Y U O S D F G H J K Z X C V B N M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts