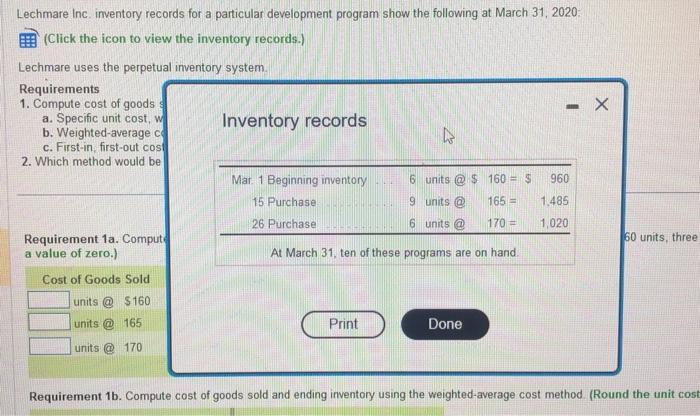

Question: Lechmare Inc. inventory records for a particular development program show the following at March 31, 2020: (Click the icon to view the inventory records.)

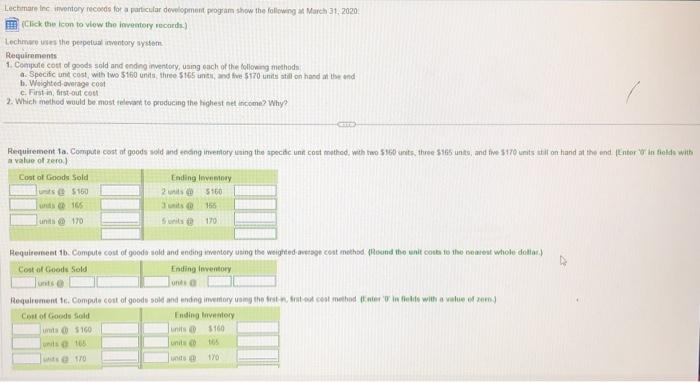

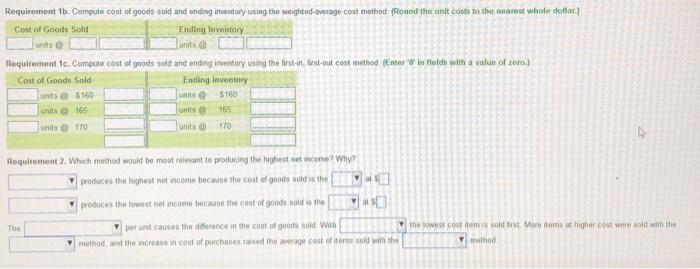

Lechmare Inc. inventory records for a particular development program show the following at March 31, 2020: (Click the icon to view the inventory records.) Lechmare uses the perpetual inventory system. Requirements 1. Compute cost of goods a. Specific unit cost, w b. Weighted-average co c. First-in, first-out cost 2. Which method would be Inventory records - X Mar. 1 Beginning inventory 15 Purchase 6 units 9 units@ $ 160 = $ 6 units 165= 170 = 960 1,485 1,020 60 units, three Requirement 1a. Compute a value of zero.) Cost of Goods Sold units @ $160 26 Purchase At March 31, ten of these programs are on hand. units 165 units @ 170 Print Done Requirement 1b. Compute cost of goods sold and ending inventory using the weighted-average cost method. (Round the unit cost Lechmare Inc. inventory records for a particular development program show the following at March 31, 2020 (Click the icon to view the inventory records.) Lechmare uses the perpetual inventory system Requirements 1. Compute cost of goods sold and ending inventory, using each of the following methods a. Specific unt cost, with two $160 units, three $165 units, and five $170 units still on hand at the end b. Weighted average cost c. First in, first-out cost 2. Which method would be most relevant to producing the highest net income? Why? Requirement 1a. Compute cost of goods sold and ending inventory using the specific unit cost method, with two $160 units, three $165 units, and five $170 units still on hand at the end (Enter in fields with a value of zero.) Cost of Goods Sold Ending Inventory units @$160 2 units 5160 unds 165 1 units 155 units 170 5units 170 Requirement 1b. Compute cost of goods sold and ending inventory using the weighted average cost method (Round the unit costs to the nearest whole dollar.) Cost of Goods Sold unts @ Ending Inventory Junts a Requirement 1c. Compute cost of goods sold and ending inventory using the fest-, frit-out cost method (Enter 0 in fields with a value of zem Cost of Goods Sold Junits $160 units @165 Ending Inventory units@ Junits $160 165 its 170 unds @ 170 Requirement 1b. Compute cost of goods sold and ending inventory using the weighted average cost method: (Round the unit costs to the nearest whole dollar.) Cost of Goods Sold Ending Inventory units @ Requirement 1c. Compute cost of goods sold and ending inventory using the first-in, first-out cost method (Enter in fields with a value of zero.) Cost of Goods Sold units $160 units 165 units 170 Ending inventory units @ $160 units @ 165 units @ 170 Requirement 2. Which method would be most relevant to producing the highest net income? Why? The produces the highest net income because the cost of goods sold is the produces the lowest net income because the cost of goods sold is the per unit causes the difference in the cost of goods sold. With method, and the increase in cost of purchases raised the average cost of items sold with the the lowest cost item is sold first. More items at higher cost were sold with the method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts