Question: - Lecobus has no preferred stock-only comnon equity, current liabilibes, and long-term debt. Find Jacobus's (2) accounts receivable, (2) ourrent liablities, (3) current assets, (4)

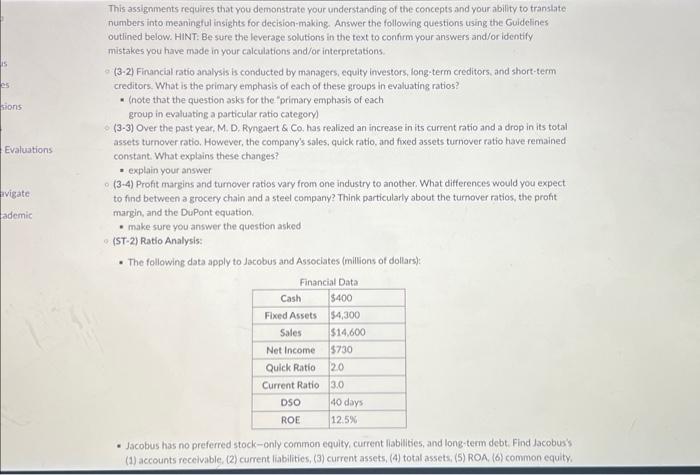

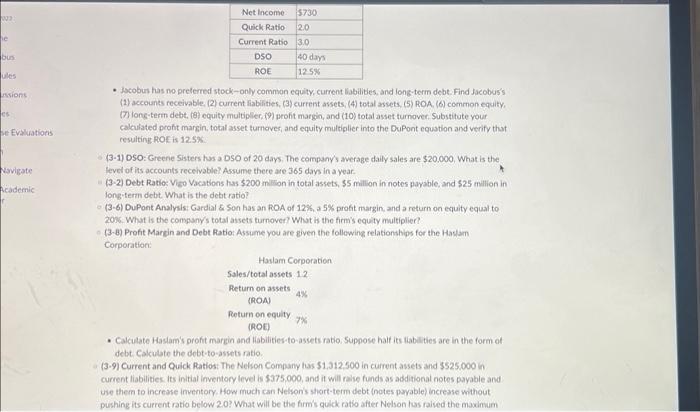

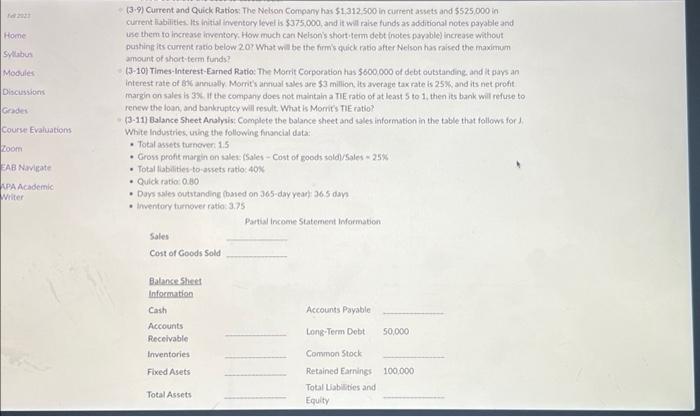

- Lecobus has no preferred stock-only comnon equity, current liabilibes, and long-term debt. Find Jacobus's (2) accounts receivable, (2) ourrent liablities, (3) current assets, (4) total assets, (5) ROA, (6) common equity, (7) lons-term debt, (8) equity multiplier, (9) profit margin, and (10) total asset turnover. Substitute vour calculated proht margin, total asset turnoves, and equity multiplier into the DuPont equation and verify that resulting ROF is 12.5% (3-1) DSO: Greene Sisters hus a DSO of 20 days. The company's awerage daily sales are $20,000, What is the fevel of its accounts receivable? Assume thete are 365 days in a year. (3-2) Debt Ratio: Vieo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt What is the detit ratio? (3-6) DuPont Analyis: Gardial & Son has an ROA of 12%, a.5\% profit margin, and a return on equity equal to 2006. What is the companys total assets turnover? What is the firn's equity multiplier? (3-a) Profit Margin and Debt Ratio: Assume vou are given the follewing relationships for the Haslam Corporation: This assignments requires that you demonstrate your understanding of the concepts and your ability to translate numbers into meaningful insights for decision-making. Answer the following questions using the Guidelines outlined below. HINT: Besure the leverage solutions in the text to confirm your answers and/or identify mistakes you have made in your calculations and/or interpretations. (3-2) Financial ratio analysis is conducted by managers, equity investors, fong-term creditors, and short-term creditors. What is the primary emphasis of each of these groups in evaluating ratios? - (note that the question asks for the "primary emphasis of each group in evaluating a particular ratio category) (3-3) Over the past year, M, D, Ryngaert \& Co, has realized an increase in its current ratio and a drop in its total assets turnover ratio. However, the company's sales, quick ratio, and foxed assets turnover ratio have remained constant. What explains these changes? - explain your answer - (3-4) Profit margins and turnover ratios vary from one industry to another. What differences would you expect. to find between a grocery chain and a steel company? Think particularly about the turnover ratios, the profit margin, and the DuPont equation. - make sure you answer the question asked (ST-2) Ratio Analysis: - The following data apply to Jacobus and Associates (millions of dollars): - Jacobus has no preferred stock-only common equity, current liabillities, and long-term debt. Find Jacobus's (1) accounts receivable, (2) current liabilities, (3) current assets, (4) total assets, (5) ROA, (6) common equity. (3.9) Current and Quick Ratios: The Nelson Company has $1,312,500 in current assets and $5,25,000 in current lijbitities. Its initis liventory level is $375,000, and it wall raise funds as additional notes payable and use them to increase inventory. How much can Nelson's shont term debt (notes payable) increave without pushing its current ratio below 20% What wa be the firm's quifck ratio after Nelson has raised the maximum amount of shortiterm funds? (3-10) Times-Interest-Earned Ratio: The Morrit Corporation has $600000 of debt outstandine, and it pars an interest rate of 8% annually. Mornth arnual wales are $3 million, itsawerage tax rate is 25%, and its net profit margin on sales is 3\%. If the company does not mulritain a TIE rato of at least 5 to 1 , then its bank wil refuse to renew the loan, and bankruptcy will result. What is Morrits ne ratio? (3-11) Balance Sheet Analyis: Complete the balance sheet and sales information in the table that follows for) White Industries, using the following financial data: - Total assets tarnover 1.5 - Gross profit margin on sales (Sales - Cost of noods sald)/Sales =25% - Total liabilibes-to assets ratio:40K - Quick ratio 0.00 - Doys weles outstandine (bared on 365-day yean): 36.5 dan - Imventary turnover ratio: 3.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts