Question: Ledger Services has prepared their weekly payroll for the week ending October 19. Gross pay is $25,000. Employees have a health plan that costs $200

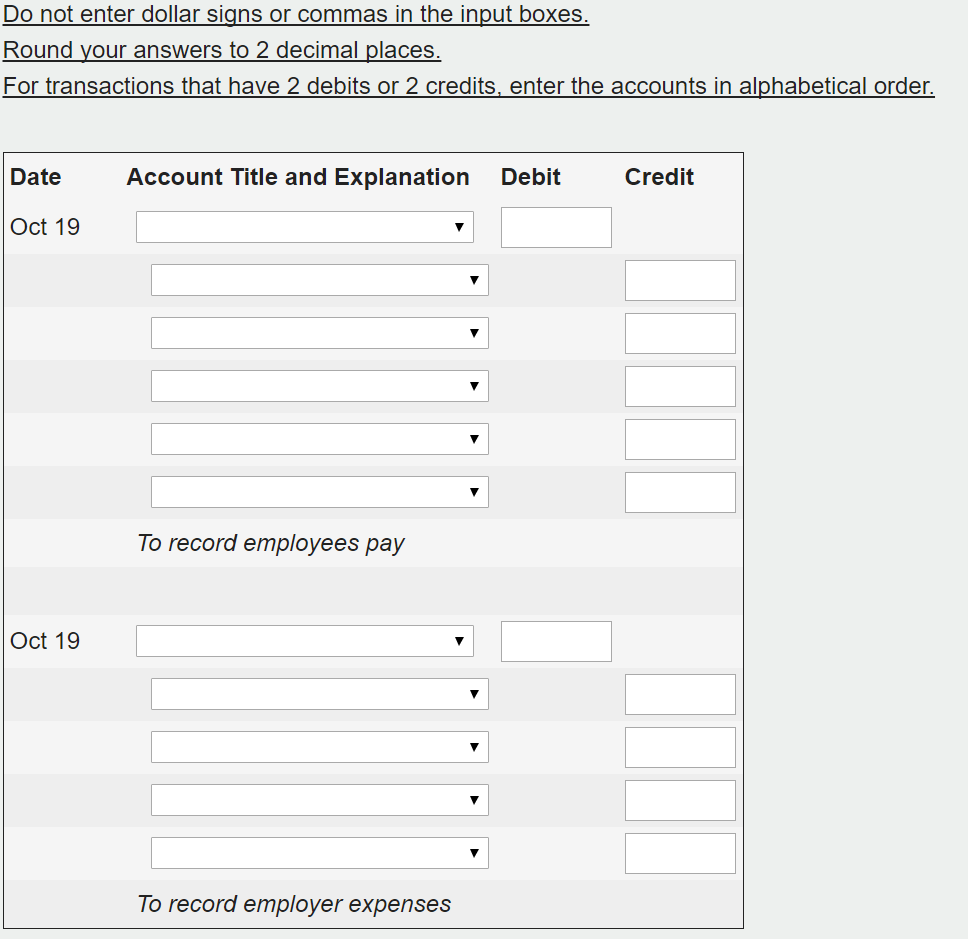

Ledger Services has prepared their weekly payroll for the week ending October 19. Gross pay is $25,000. Employees have a health plan that costs $200 per week. This cost is shared equally between the employees and the employer. Using the deduction rates provided below, prepare the journal entries to record the salaries payable to the employees and to accrue the employer contributions.

Federal income tax is 9%.

State income tax is 5%.

FICA is 7.65%.

FUTA is 0.6%.

SUTA is 5.4%.

Do not enter dollar signs or commas in the input boxes Round vour answers to 2 decimal places For transactions that have 2 debits or 2 credits, enter the accounts in alphabetical order Date Account Title and Explanation Debit Credit Oct 19 To record employees pay Oct 19 To record employer expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts