Question: Leeds Ltd has decided to construct two buildings which meet the definition of qualifying assets: The construction of the first building was started on

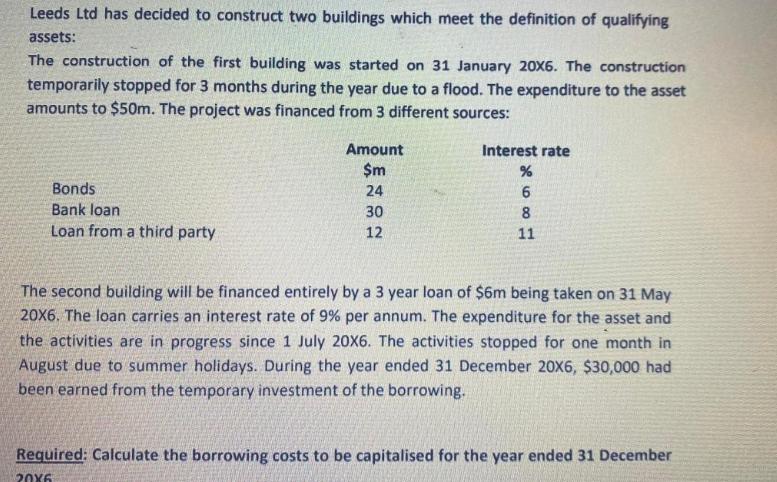

Leeds Ltd has decided to construct two buildings which meet the definition of qualifying assets: The construction of the first building was started on 31 January 20X6. The construction temporarily stopped for 3 months during the year due to a flood. The expenditure to the asset amounts to $50m. The project was financed from 3 different sources: Bonds Bank loan Loan from a third party Amount $m 24 30 12 Interest rate 1681 % The second building will be financed entirely by a 3 year loan of $6m being taken on 31 May 20X6. The loan carries an interest rate of 9% per annum. The expenditure for the asset and the activities are in progress since 1 July 20X6. The activities stopped for one month in August due to summer holidays. During the year ended 31 December 20X6, $30,000 had been earned from the temporary investment of the borrowing. Required: Calculate the borrowing costs to be capitalised for the year ended 31 December 20X6

Step by Step Solution

There are 3 Steps involved in it

To calculate the borrowing costs to be capitalized for the year ended 31 December 20X6 we need to de... View full answer

Get step-by-step solutions from verified subject matter experts