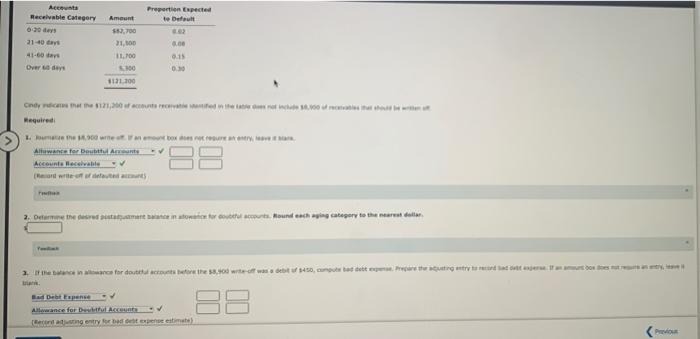

Question: left side is the intro right side is the problems that I need help on Amount Propertien Expected teet Acta Receivable Category 6:30 21-40 days

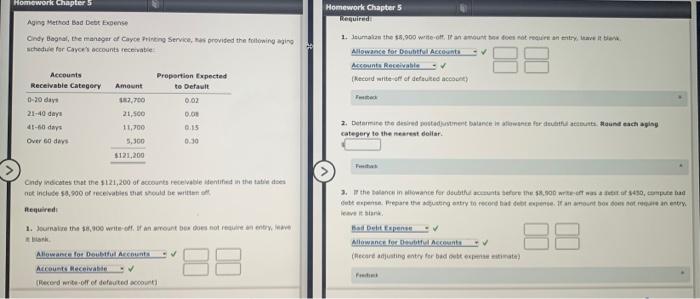

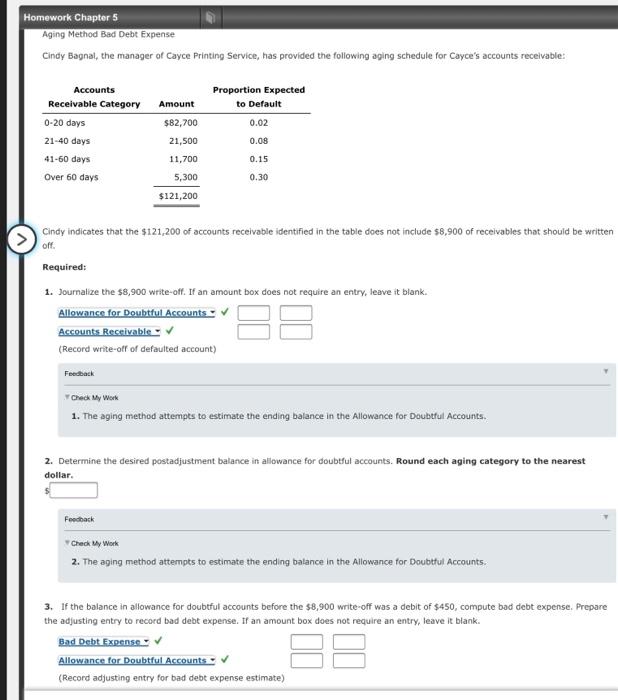

Amount Propertien Expected teet Acta Receivable Category 6:30 21-40 days 41-60 Over 55,700 21.10 11.700 8.00 0.15 1171.100 Cody C 12 comme un hombre Required me me 1.200 mm x REM Allowance for Best A Account Receivable for rent 2. Darm the entrate sunt in tonic ter cet accounts. Round each wing category to the nearen eta 2. for det at the 58.00 wow $450, cu baretto Debat pene Allowance for Des Account gentry for expenses 88 PM Homework Chapter 5 Regud Homework Chapter Aging Method Bad Dot bene Cindy Bagal, the manager of Cayce hinting Services provided the fringing schedule for Cayce's accounts receivable 1. umaton the 58.900 wide- on to does not an entry wave it Allowance for Debte Account Accounts Receivable Record write off of defuted ) Accounts Receivable Category 0-20 days 21-40 days Tube Amount $82,700 21,500 11,700 5.300 $121,200 Proportion Expected to Default 0.02 0.00 0.15 0.30 41-60 days Over 60 days 2. Detamine the desired retinere for det att Hound eaching category to the nearest dollar Cindy indicates that the $121,200 of counts receivable end in the tatilde not include 58.900 of receives that should be written alt Required 1. Some the $2,000 water tan wont be coes not remunten entry Move 3. the dance in lowance for the counter the $8.00 wita 40, com a Gutte prepare the try to record hatte in amount to contenery Bad Debit pense Allowance for Del Account (ecare justing entry for date 88 Allowance for Doubt Ace Account deceivable Record write-off of deated account 88 Homework Chapter 5 Aging Method Bad Debt Expense Cindy Bagnal, the manager of Cayce Printing Service, has provided the following aging schedule for Cayce's accounts receivable: Accounts Receivable Category 0-20 days Proportion Expected to Default 0.02 0.08 21-40 days 41-60 days Amount $82,700 21,500 11,700 5,300 $121,200 0.15 Over 60 days 0.30 Cindy indicates that the $121,200 of accounts receivable identified in the table does not include $8,900 of receivables that should be written off Required: 1. Journalize the $8,900 write-off. If an amount box does not require an entry, leave it blank. Allowance for Doubtful Accounts Accounts Receivable (Record write-off of defaulted account) Feedback Check My Work 1. The aging method attempts to estimate the ending balance in the Allowance for Doubtful Accounts. 2. Determine the desired postadjustment balance in allowance for doubtful accounts. Round each aging category to the nearest dollar. Feedback Check My Work 2. The aging method attempts to estimate the ending balance in the Allowance for Doubtful Accounts. 3. If the balance in allowance for doubtful accounts before the $8,900 write-off was a debit of $450, compute bad debt expense. Prepare the adjusting entry to record bad debt expense. If an amount box does not require an entry, leave it blank. Bad Debt Expense Allowance for Doubtful Accounts (Record adjusting entry for bad debt expense estimate) 88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts