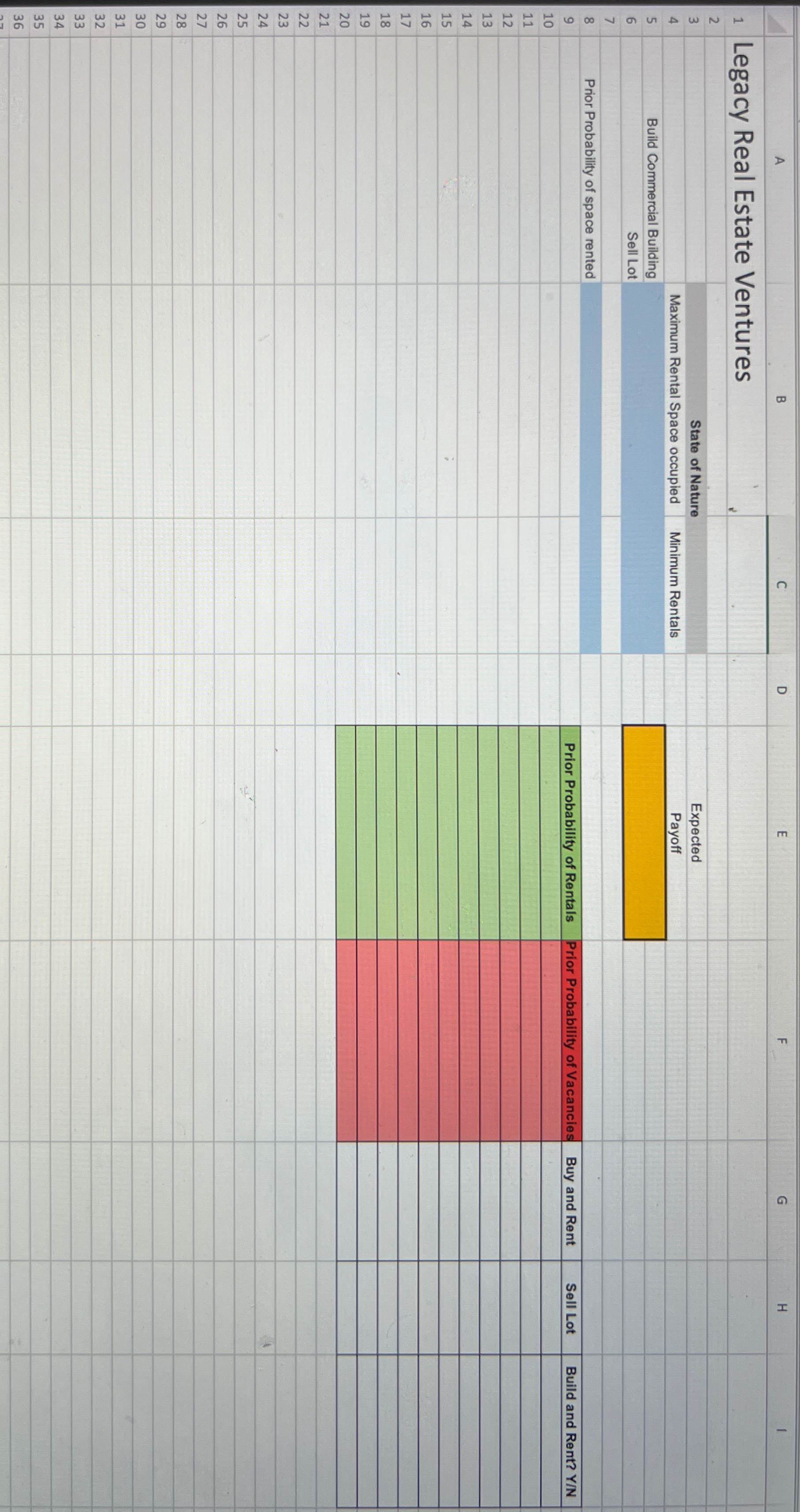

Question: Legacy Real Estate Ventures is making a decision whether or not to develop a commercial property they own. Currently, their analysis is based upon percentage

Legacy Real Estate Ventures is making a decision whether or not to develop a commercial property they own. Currently, their analysis is based upon percentage of commercial space used. Their property before building has offers for $The decision is to build or sell. At this time, the commercial building Legacy is deciding to build would provide the company $ if fully rented. However, it would cost them $ to build Complete a prior probabilities chart to give management a picture of financial outcomes and decisions. Start your Prior Probability of Rentals at Complete this thru Start your Prior Probability of Vacancies at Descend this rate and complete this thru At what occupation rate would Legacy require to make a profit? Use this as your final answer

Legacy Real Estate Ventures

State of Nature

Maximum Rental Space occupied

Minimum Rentals

Build Commercial Building Sell Lot

Prior Probability of space rented

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock