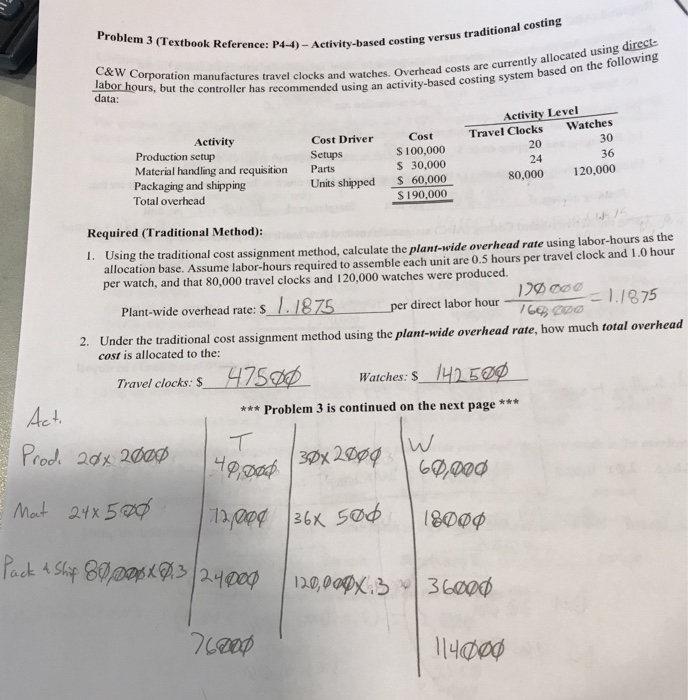

Question: lem 3 (Textbook Reference: P4-4)- Activity-based costing vers C&W Corporation lab data: ion manufactures travel clocks and watches, Overhead costs are currently all ut the

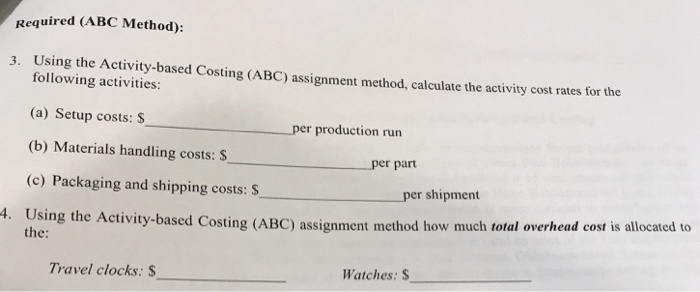

lem 3 (Textbook Reference: P4-4)- Activity-based costing vers C&W Corporation lab data: ion manufactures travel clocks and watches, Overhead costs are currently all ut the controller has recommended using an activity-based costing system Activity Level Cost Driver Setups Parts Units shipped Cost Travel Clocks Watches 30 36 80,000 20,000 Activity $ 100,000 S 30,000 20 24 Production setup Material handling and requisition Packaging and shipping Total overhead 60,000 S 190,000 Required (Traditional Method): allocation base. Assume labor-hours required to assemble each unit are 0.5 hours per travel clock and 1.0 hour per watch, and that 80,000 travel clocks and 120,000 watches were produced. I. Using the traditional cost assignment method, calculate the plant-wide overhead rate using labor-hours as the 1.1875 Plant-wide overhead rate: s / .1875 per direct labor hour T 2. Under the traditional cost assignment method using the plant-wide overhead rate, how much total overhead cost is allocated to the: Travel clocks:5Watches 41 5p Watches: $ Act ***Problem 3 is continued on the next page***

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts