Question: lem 6 Help Save& Exit Submit Saved Check my work On January 1, 2018, Tonge Industries had outstanding 760,000 common shares ($1 par) that originally

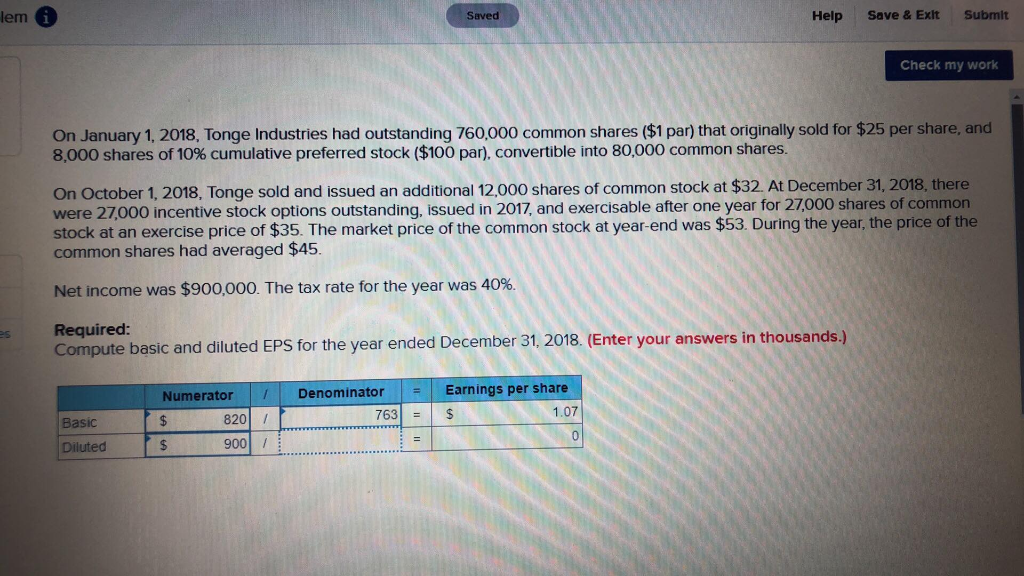

lem 6 Help Save& Exit Submit Saved Check my work On January 1, 2018, Tonge Industries had outstanding 760,000 common shares ($1 par) that originally sold for $25 per share, and 8,000 shares of 10% cumulative preferred stock ($100 par), convertible into 80,000 common shares. On October 1, 2018, Tonge sold and issued an additional 12,000 shares of common stock at $32. At December 31, 2018, there were 27,000 incentive stock options outstanding, issued in 2017, and exercisable after one year for 27000 shares of common stock at an exercise price of $35. The market price of the common stock at year-end was $53. During the year, the price of the common shares had averaged $45. Net income was $900,000. The tax rate for the year was 40%. Required Compute basic and diluted EPS for the year ended December 31, 2018. (Enter your answers in thousands.) Denominator Earnings per share Numerator 820 / 763$ 1.07 Basic Diluted 900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts