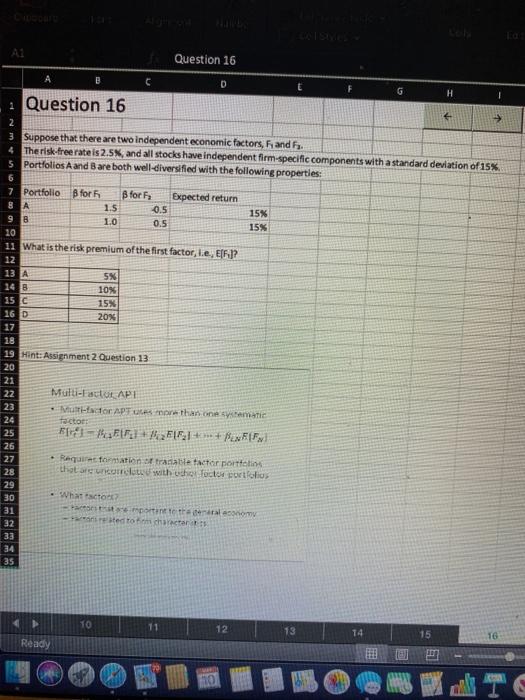

Question: Les Question 16 A B 0 E Question 16 2 3 Suppose that there are two independent economic factors, and 4 The risk-free rate is

Les Question 16 A B 0 E Question 16 2 3 Suppose that there are two independent economic factors, and 4 The risk-free rate is 2.5%, and all stocks have independent firm-specific components with a standard deviation of 15% 5 Portfolios A and B are both well-diversified with the following properties: 7 Portfolio B for B for Expected return 1.5 -0.5 15% 9 B 1,0 0.5 15% 10 11 What is the risk premium of the first factor, le, EF? 12 13 A SX 14 B 10% 15 c 15% 16 D 20% 17 18 19 Hint: Assignment 2 Question 13 20 21 22 Multi-Factor API 23 MAP more than one man 24 factor 25 - PEF: 215+*+ PexFx 26 27 Requires formation of tranable actor portato 28 that arcukrot with other factor fortfolio 29 30 Whatsconde 31 portant to talem 32 ited to characters 33 35 10 11 12 13 14 15 16 Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts