Question: Lesedi is working as a program manager for a big insurance company. She was appointed as contractor and currently only works 5 0 hours per

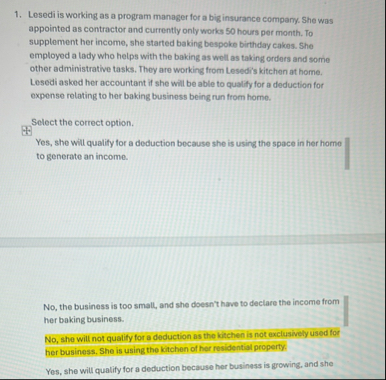

Lesedi is working as a program manager for a big insurance company. She was appointed as contractor and currently only works hours per month. To supplement her income, she started baking bespoke birthday cakes. She employed a lady who helps with the baking as well as taking orders and some other administrative tasks. They are working from Lesed's kitchen at home. Lesedi asked her accountant if she will be able to qualify for a deduction for expense relating to her baking business being run from home.

Select the correct option.

Yes, she will qualify for a deduction because she is using the space in her home to generate an income.

No the business is too small, and she doesn't have to declare the income from her baking business.

No she will not qualify for a deduction as the kitchen is not exclusively used for her business. She is using the kitchen of her residential property.

Yes, she will quality for a deduction because her business is growing, and she

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock