Question: Lespondus LockDown Browser + Webcam Michael D'urbano: Attempt 1 2:08:27 stion 4 (7.69 points) 1. Hazeera bought 5,000 shares of IBM on July 3,

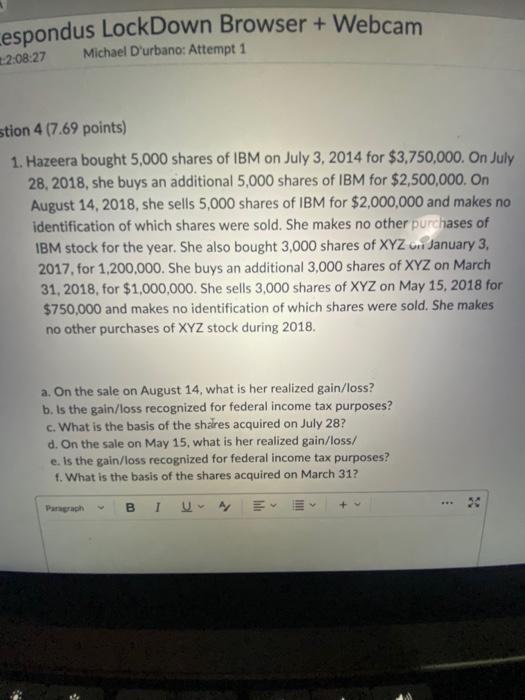

Lespondus LockDown Browser + Webcam Michael D'urbano: Attempt 1 2:08:27 stion 4 (7.69 points) 1. Hazeera bought 5,000 shares of IBM on July 3, 2014 for $3,750,000. On July 28, 2018, she buys an additional 5,000 shares of IBM for $2,500,000. On August 14, 2018, she sells 5,000 shares of IBM for $2,000,000 and makes no identification of which shares were sold. She makes no other purchases of IBM stock for the year. She also bought 3,000 shares of XYZ on January 3, 2017, for 1,200,000. She buys an additional 3,000 shares of XYZ on March 31, 2018, for $1,000,000. She sells 3,000 shares of XYZ on May 15, 2018 for $750,000 and makes no identification of which shares were sold. She makes no other purchases of XYZ stock during 2018. a. On the sale on August 14, what is her realized gain/loss? b. Is the gain/loss recognized for federal income tax purposes? c. What is the basis of the shares acquired on July 28? d. On the sale on May 15, what is her realized gain/loss/ e. Is the gain/loss recognized for federal income tax purposes? f. What is the basis of the shares acquired on March 31? BIU A Paragraph

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

a On the sale on August 14 her realized gainloss is a loss of 500000 Calculation Cost basis of t... View full answer

Get step-by-step solutions from verified subject matter experts