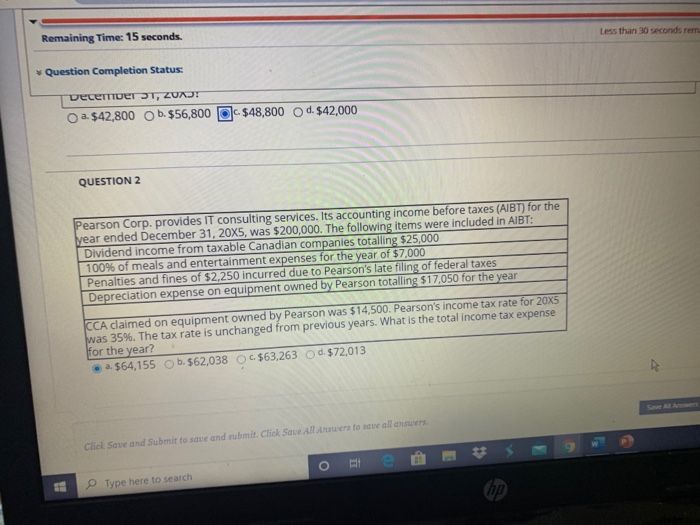

Question: Less than 30 seconds rern Remaining Time: 15 seconds. Question Completion Status: December 31, ZUAJ! a $42,800 Ob. $56,800 O $48,800 Od. $42,000 QUESTION 2

Less than 30 seconds rern Remaining Time: 15 seconds. Question Completion Status: December 31, ZUAJ! a $42,800 Ob. $56,800 O $48,800 Od. $42,000 QUESTION 2 Pearson Corp. provides IT consulting services. Its accounting income before taxes (AIBT) for the year ended December 31, 20X5, was $200,000. The following items were included in AIBT: Dividend income from taxable Canadian companies totalling $25,000 100% of meals and entertainment expenses for the year of $7,000 Penalties and fines of $2,250 incurred due to Pearson's late filing of federal taxes Depreciation expense on equipment owned by Pearson totalling $17,050 for the year CCA claimed on equipment owned by Pearson was $14,500. Pearson's income tax rate for 20x5 was 35%. The tax rate is unchanged from previous years. What is the total income tax expense for the year? 1.564,155 b. $62,038 O C. $63,263 O d. $72,013 See Alons Click Save and Submit to save and submit. Click Save All Are to all our Type here to search hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts