Question: Lesson 2.6 Homework Complete problems 1-3 below for independent practice. Find all the deductions asked for, and the final net pay. Social Security is 6.2%

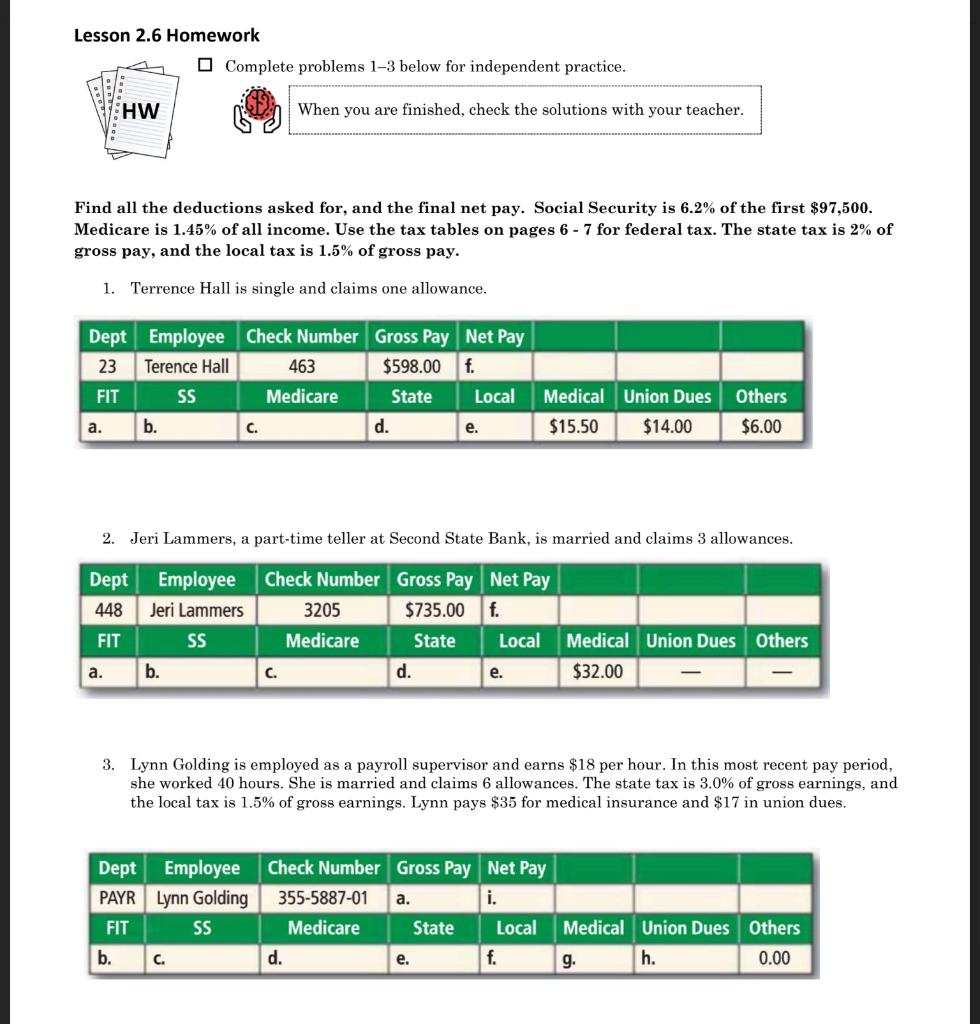

Lesson 2.6 Homework Complete problems 1-3 below for independent practice. Find all the deductions asked for, and the final net pay. Social Security is 6.2% of the first $97,500. Medicare is 1.45% of all income. Use the tax tables on pages 67 for federal tax. The state tax is 2% of gross pay, and the local tax is 1.5% of gross pay. 1. Terrence Hall is single and claims one allowance. 2. Jeri Lammers, a part-time teller at Second State Bank, is married and claims 3 allowances. 3. Lynn Golding is employed as a payroll supervisor and earns $18 per hour. In this most recent pay period, she worked 40 hours. She is married and claims 6 allowances. The state tax is 3.0% of gross earnings, and the local tax is 1.5% of gross earnings. Lynn pays $35 for medical insurance and $17 in union dues. Lesson 2.6 Homework Complete problems 1-3 below for independent practice. Find all the deductions asked for, and the final net pay. Social Security is 6.2% of the first $97,500. Medicare is 1.45% of all income. Use the tax tables on pages 67 for federal tax. The state tax is 2% of gross pay, and the local tax is 1.5% of gross pay. 1. Terrence Hall is single and claims one allowance. 2. Jeri Lammers, a part-time teller at Second State Bank, is married and claims 3 allowances. 3. Lynn Golding is employed as a payroll supervisor and earns $18 per hour. In this most recent pay period, she worked 40 hours. She is married and claims 6 allowances. The state tax is 3.0% of gross earnings, and the local tax is 1.5% of gross earnings. Lynn pays $35 for medical insurance and $17 in union dues

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts