Question: Lesson 7-R: Problem 24 Previous Problem List Next date in the 11th to 19 years. (1 point) Gabriel purchased a 19-year 5% semiannual coupons bond

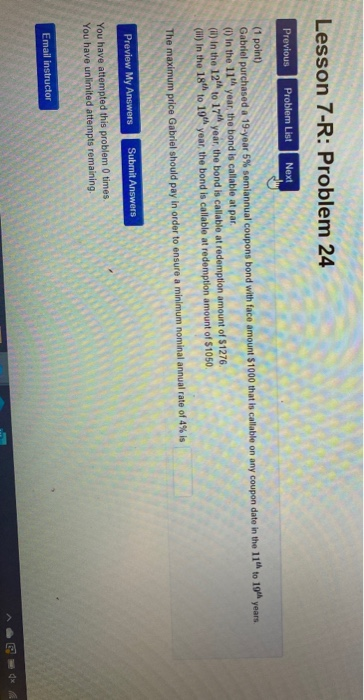

Lesson 7-R: Problem 24 Previous Problem List Next date in the 11th to 19 years. (1 point) Gabriel purchased a 19-year 5% semiannual coupons bond with face amount 51000 that is call () in the 11 year, the bond is callable at par (it) in the 12 to 17th year, the bond is callable at redemption amount of 51276 (H) In the 18 to 19 year, the bond is callable at redemption amount of 1050 The maximum price Gabriel should pay in order to ensure a minimum nominal annual rate Preview My Answers Submit Answers You have attempted this problem 0 times You have unlimited attempts remaining Email instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts