Question: Lessor Ltd, who leases out equipment, has requested your help because their accountant has gone on extended stress leave. The lease details, for an item

Required:

Assume the lease was classified as a finance lease:

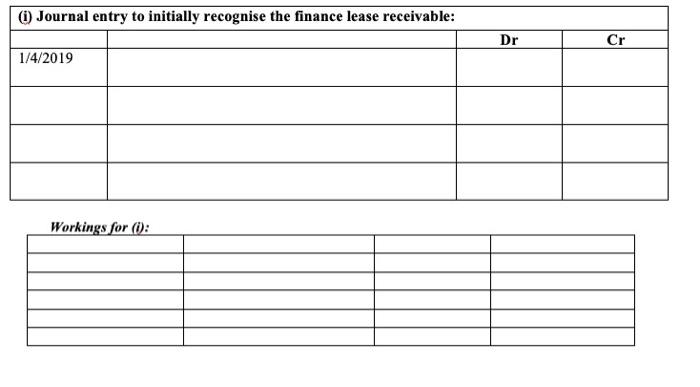

(i) Prepare the journal entry, on the commencement date, to initially recognise the finance lease receivable. Show your workings.

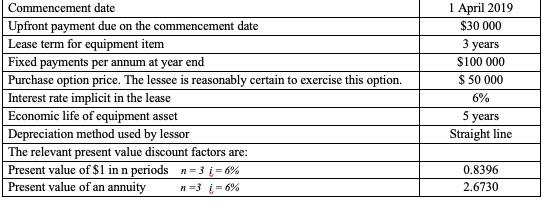

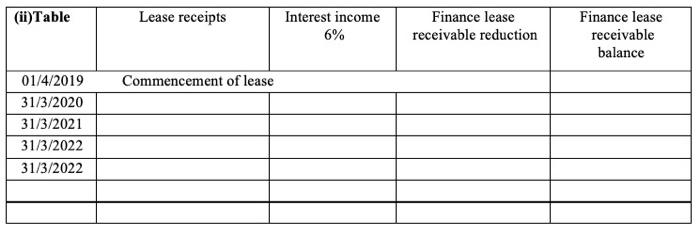

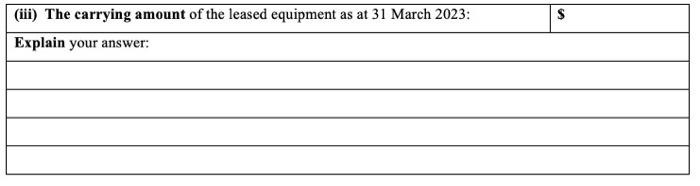

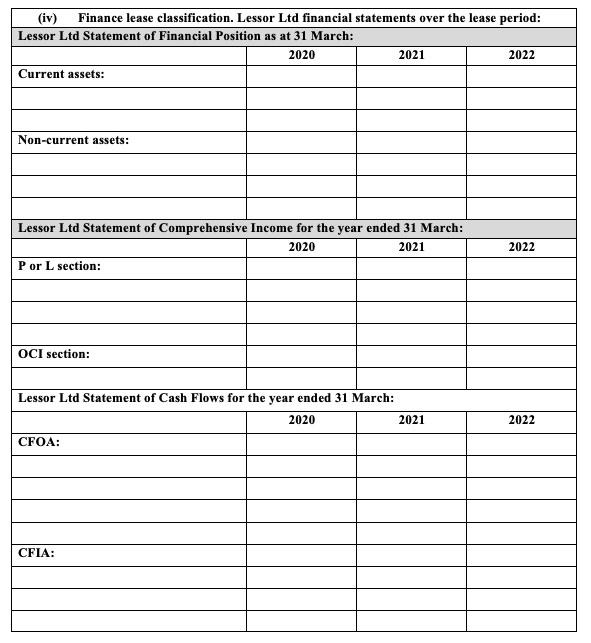

1 April 2019 $30 000 3 years Commencement date Upfront payment due on the commencement date Lease term for equipment item Fixed payments per annum at year end Purchase option price. The lessee is reasonably certain to exercise this option. Interest rate implicit in the lease Economic life of equipment asset Depreciation method used by lessor The relevant present value discount factors are: Present value of $1 in n periods n=31-6% Present value of an annuity n=3 i = 6% $100 000 $ 50 000 6% 5 years Straight line 0.8396 2.6730 (1) Journal entry to initially recognise the finance lease receivable: Dr Cr 1/4/2019 Workings for (i): (ii)Table Lease receipts Interest income 6% Finance lease receivable reduction Finance lease receivable balance Commencement of lease 01/4/2019 31/3/2020 31/3/2021 31/3/2022 31/3/2022 $ (iii) The carrying amount of the leased equipment as at 31 March 2023: Explain your answer: (iv) Finance lease classification. Lessor Ltd financial statements over the lease period: Lessor Ltd Statement of Financial Position as at 31 March: 2020 2021 2022 Current assets: Non-current assets: Lessor Ltd Statement of Comprehensive Income for the year ended 31 March: 2020 2021 Por L section: 2022 OCI section: Lessor Ltd Statement of Cash Flows for the year ended 31 March: 2020 2021 2022 CFOA: CFIA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts