Question: Let 0 < K < K. Assume that the underlying stock price S, follows the Black-Scholes model, with drift , volatility and So initial

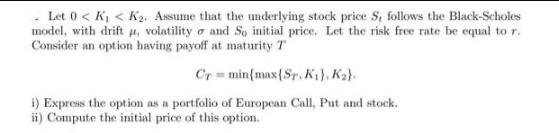

Let 0 < K < K. Assume that the underlying stock price S, follows the Black-Scholes model, with drift , volatility and So initial price. Let the risk free rate be equal to r. Consider an option having payoff at maturity T Cr=min(max(Sr. K), K). i) Express the option as a portfolio of European Call, Put and stock. ii) Compute the initial price of this option.

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

It seems like there may be a typo in your question as you mentioned 0 K K which doesnt make sense Ill assume you meant that 0 K S0 where S0 is the ini... View full answer

Get step-by-step solutions from verified subject matter experts