Question: Let K < K be two strike prices, each associated with a different call. These two calls are European calls, both on the same

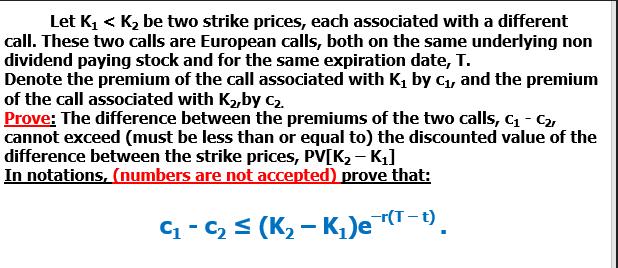

Let K < K be two strike prices, each associated with a different call. These two calls are European calls, both on the same underlying non dividend paying stock and for the same expiration date, T. Denote the premium of the call associated with K by C, and the premium of the call associated with K,by C. Prove: The difference between the premiums of the two calls, C-C cannot exceed (must be less than or equal to) the discounted value of the difference between the strike prices, PV[K - K] In notations, (numbers are not accepted) prove that: C-C (K-K)e(T-t)

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

To demonstrate that C C K Ke rt where r is the gamble free loan cost and t is the chance to lapse we can involve the idea of noexchange in choices val... View full answer

Get step-by-step solutions from verified subject matter experts