Question: Let me know if I need to add anything else LO 3.3) Prob.2.b. Upon examination of the account balances above, Beerbo determined that certain accounts

Let me know if I need to add anything else

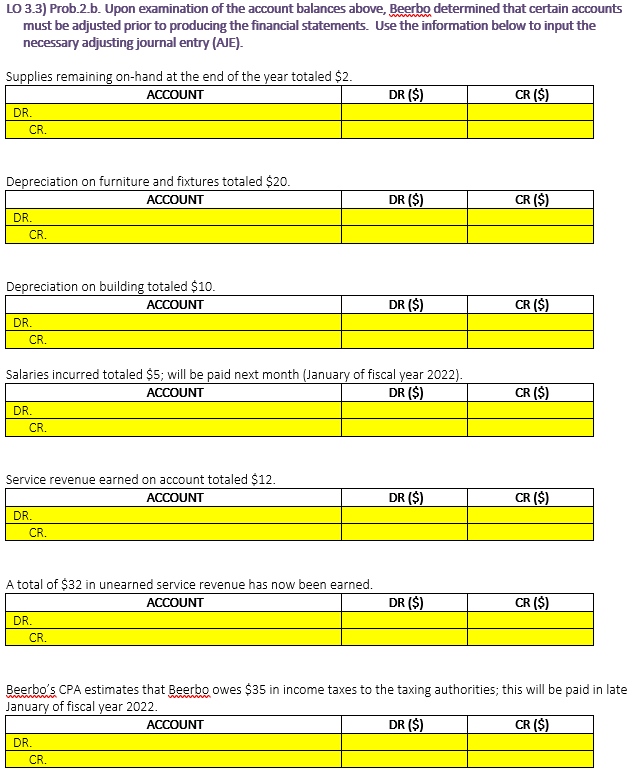

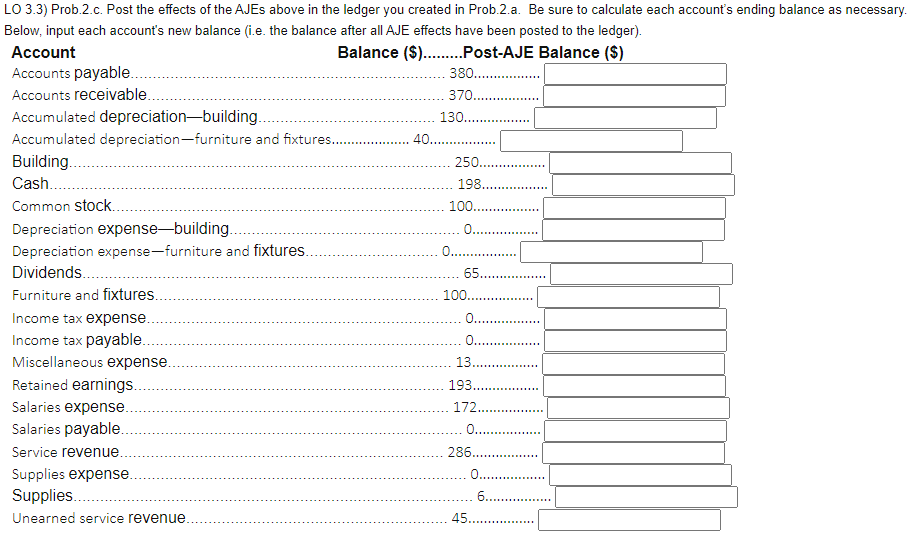

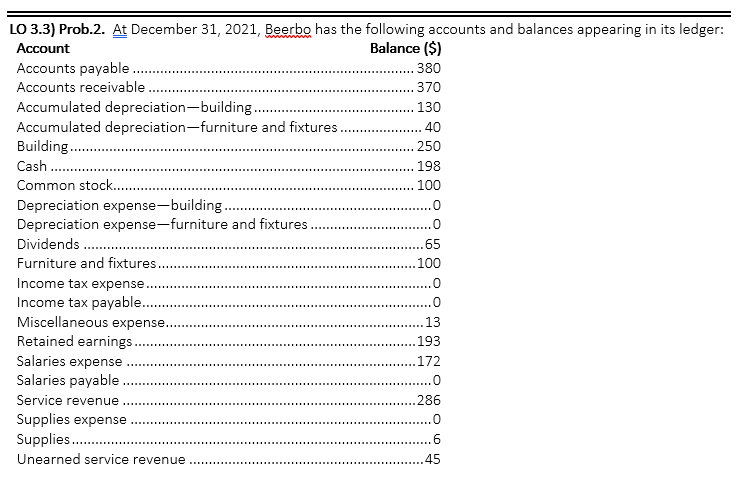

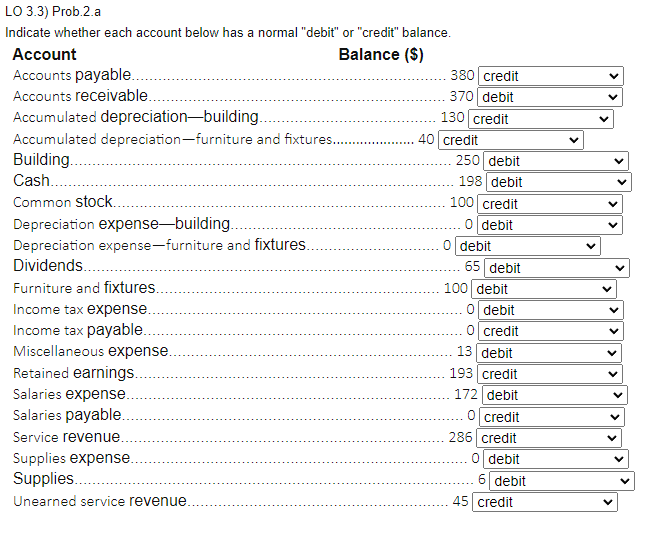

LO 3.3) Prob.2.b. Upon examination of the account balances above, Beerbo determined that certain accounts must be adjusted prior to producing the financial statements. Use the information below to input the necessary adjusting journal entry (AJE). Supplies remaining on-hand at the end of the year totaled $2. ACCOUNT DR ($) CR ($) DR. CR. Depreciation on furniture and fixtures totaled $20. ACCOUNT DR. CR. DR ($) CR ($) Depreciation on building totaled $10. ACCOUNT DR. CR. DR ($) CR ($) Salaries incurred totaled $5; will be paid next month January of fiscal year 2022). ACCOUNT DR ($) DR. CR. CR ($) Service revenue earned on account totaled $12. ACCOUNT DR. CR. DR ($) CR ($) A total of $32 in unearned service revenue has now been earned. ACCOUNT DR. CR. DR ($) CR ($) Beerbo's CPA estimates that Beerbo owes $35 in income taxes to the taxing authorities; this will be paid in late January of fiscal year 2022. ACCOUNT DR ($) CR ($) DR. CR. LO 3.3) Prob.2.c. Post the effects of the AJEs above in the ledger you created in Prob.2.a. Be sure to calculate each account's ending balance as necessary. Below, input each account's new balance (i.e. the balance after all AJE effects have been posted to the ledger). Account Balance ($)..........Post-AJE Balance ($) Accounts payable. 380... Accounts receivable. 370. Accumulated depreciation-building.. 130... Accumulated depreciation-furniture and fixtures............ 40.... Building... 250.......... Cash..... 198 Common stock.. 100. Depreciation expense-building... 0........... Depreciation expense-furniture and fixtures.. 0............. Dividends.. 65....... Furniture and fixtures. 100. Income tax expense. 0. Income tax payable... 0. Miscellaneous expense.. 13.. Retained earnings. 193.. Salaries expense. 172. Salaries payable. Service revenue. 286.. Supplies expense. 0.. Supplies........ 6........ Unearned service revenue. 45.......... 0. LO 3.3) Prob.2. At December 31, 2021, Beerbo has the following accounts and balances appearing in its ledger: Account Balance ($) Accounts payable 380 Accounts receivable ..... 370 Accumulated depreciation-building... 130 Accumulated depreciation-furniture and fixtures. 40 Building. 250 Cash ......... 198 Common stock.. 100 Depreciation expense-building..... 0 Depreciation expense-furniture and fixtures .0 Dividends ...... .65 Furniture and fixtures. 100 Income tax expense.. 0 Income tax payable... .0 Miscellaneous expense.. 13 Retained earnings 193 Salaries expense .172 Salaries payable 0 Service revenue .286 Supplies expense 0 Supplies........ 6 Unearned service revenue 45 to > LO 3.3) Prob.2.a Indicate whether each account below has a normal "debit" or "credit" balance. Account Balance ($) 380 credit Accounts payable. Accounts receivable 370 debit Accumulated depreciation-building. 130 credit 40 credit Accumulated depreciation-furniture and fixtures........ Building. 250 debit 198 debit Cash...... Common stock.. 100 credit O debit Depreciation expense-building. O debit Depreciation expense-furniture and fixtures.. Dividends........ 65 debit 100 debit Furniture and fixtures. O debit Income tax expense. o credit Income tax payable. Miscellaneous expense. 13 debit Retained earnings. 193 credit Salaries expense. 172 debit Salaries payable. O credit 286 credit Service revenue. O debit Supplies expense. 6 debit Supplies...... Unearned service revenue. 45 credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts