Question: let me know if you it is difficult to read. thank you will upvote. Need help ASAP Short Answer Problem - 4 Points Possible -

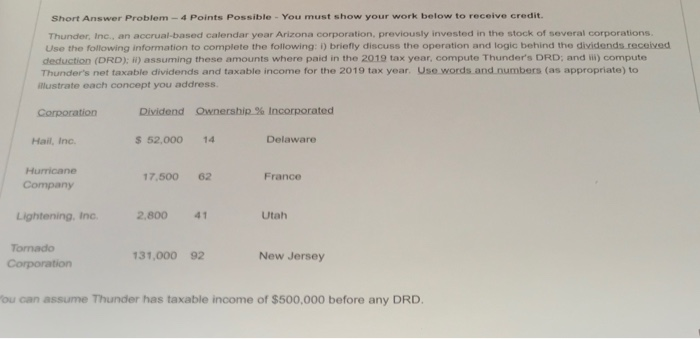

Short Answer Problem - 4 Points Possible - You must show your work below to receive credit. Thunder, Inc., an accrual-based calendar year Arizona corporation, previously invested in the stock of several corporations. Use the following information to complete the following: i) briefly discuss the operation and logic behind the dividends received deduction (DRD); ) assuming these amounts where paid in the 2019 tax year, compute Thunder's DRD; and ) compute Thunder's net taxable dividends and taxable income for the 2019 tax year. Use words and numbers (as appropriate) to illustrate each concept you address Corporation Dividend Ownership % Incorporated Hail, Inc. $ 52,000 14 Delaware Hurricane Company 17.500 62 France Lightening, Inc 2,800 41 Utah Tornado Corporation 131.000 92 New Jersey ou can assume Thunder has taxable income of $500,000 before any DRD. Short Answer Problem - 4 Points Possible - You must show your work below to receive credit. Thunder, Inc., an accrual-based calendar year Arizona corporation, previously invested in the stock of several corporations. Use the following information to complete the following: i) briefly discuss the operation and logic behind the dividends received deduction (DRD); ) assuming these amounts where paid in the 2019 tax year, compute Thunder's DRD; and ) compute Thunder's net taxable dividends and taxable income for the 2019 tax year. Use words and numbers (as appropriate) to illustrate each concept you address Corporation Dividend Ownership % Incorporated Hail, Inc. $ 52,000 14 Delaware Hurricane Company 17.500 62 France Lightening, Inc 2,800 41 Utah Tornado Corporation 131.000 92 New Jersey ou can assume Thunder has taxable income of $500,000 before any DRD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts