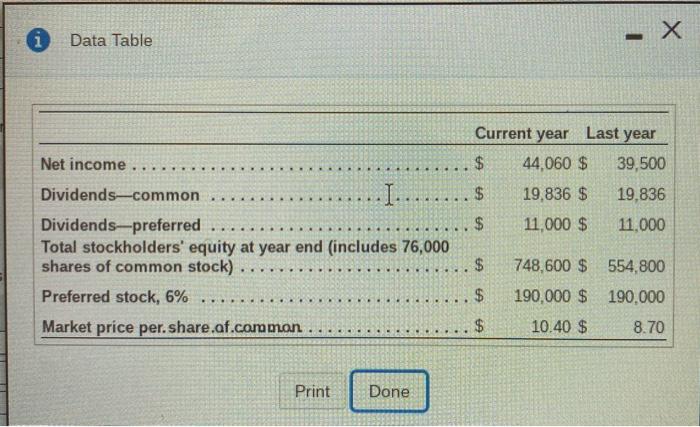

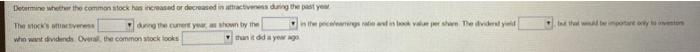

Question: let me know if you need anything else! blanks 1-3: increaed/ decresed blank 4: less atractive/ more atractive Data Table Current year Last year $

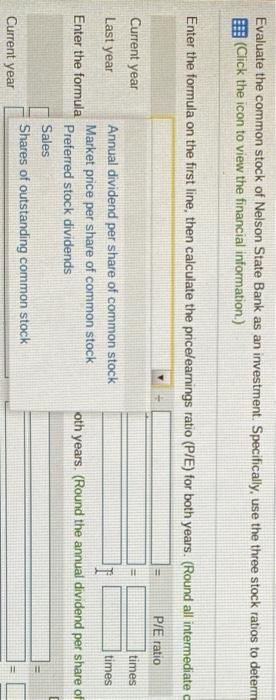

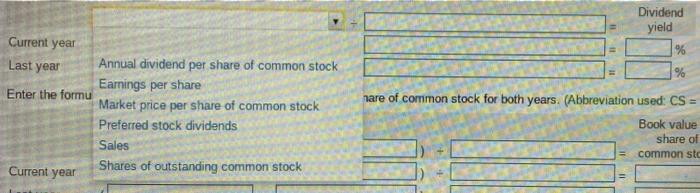

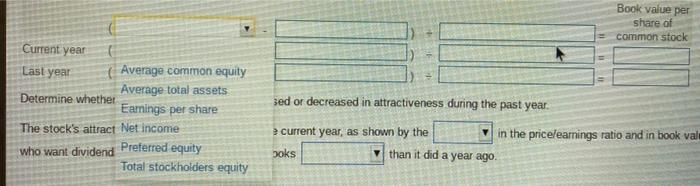

Data Table Current year Last year $ 44,060 $ 39,500 $ 19,836 $ 19,836 $ 11,000 $ 11,000 . Net income Dividends-common I.. Dividends-preferred Total stockholders' equity at year end (includes 76,000 shares of common stock) Preferred stock, 6% Market price per.share.af.common $ .... 748,600 $ 554,800 190,000 $ 190,000 $ EA .. $ 10.40 $ 8.70 Print Done Evaluate the common stock of Nelson State Bank as an investment. Specifically, use the three stock ratios to determ (Click the icon to view the financial information) Enter the formula on the first line, then calculate the pricelearnings ratio (P/E) for both years (Round all intermediate P/E ratio times Current year Last year times oth years. (Round the annual dividend per share of Annual dividend per share of common stock Market price per share of common stock Enter the formula Preferred stock dividends Sales Shares of outstanding common stock Current year = 11 Dividend yield % Current year Last year Annual dividend per share of common stock Earnings per share Enter the formu Market price per share of common stock Preferred stock dividends Sales Shares of outstanding common stock Current year hare of common stock for both years. (Abbreviation used: CS = Book value share of common sto Book value per share of common stock Last year sed or decreased in attractiveness during the past year. Current year Average common equity Average total assets Determine whether Earnings per share The stock's attract Net income Preferred equity who want dividend Total stockholders equity current year, as shown by the in the pricelearnings ratio and in book valu boks than it did a year ago Determine whether the common stock horsed or decreased in that during the past you The o's current shown by the news in the video y who want dividends Over the common stock looks tunidd your twicevo Data Table Current year Last year $ 44,060 $ 39,500 $ 19,836 $ 19,836 $ 11,000 $ 11,000 . Net income Dividends-common I.. Dividends-preferred Total stockholders' equity at year end (includes 76,000 shares of common stock) Preferred stock, 6% Market price per.share.af.common $ .... 748,600 $ 554,800 190,000 $ 190,000 $ EA .. $ 10.40 $ 8.70 Print Done Evaluate the common stock of Nelson State Bank as an investment. Specifically, use the three stock ratios to determ (Click the icon to view the financial information) Enter the formula on the first line, then calculate the pricelearnings ratio (P/E) for both years (Round all intermediate P/E ratio times Current year Last year times oth years. (Round the annual dividend per share of Annual dividend per share of common stock Market price per share of common stock Enter the formula Preferred stock dividends Sales Shares of outstanding common stock Current year = 11 Dividend yield % Current year Last year Annual dividend per share of common stock Earnings per share Enter the formu Market price per share of common stock Preferred stock dividends Sales Shares of outstanding common stock Current year hare of common stock for both years. (Abbreviation used: CS = Book value share of common sto Book value per share of common stock Last year sed or decreased in attractiveness during the past year. Current year Average common equity Average total assets Determine whether Earnings per share The stock's attract Net income Preferred equity who want dividend Total stockholders equity current year, as shown by the in the pricelearnings ratio and in book valu boks than it did a year ago Determine whether the common stock horsed or decreased in that during the past you The o's current shown by the news in the video y who want dividends Over the common stock looks tunidd your twicevo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts