Question: Let Ri denote the simple return on asset i, (i = 1, .-. N) with E[R;] = Hi, var(R;) = 0; and cov(R, R;) =

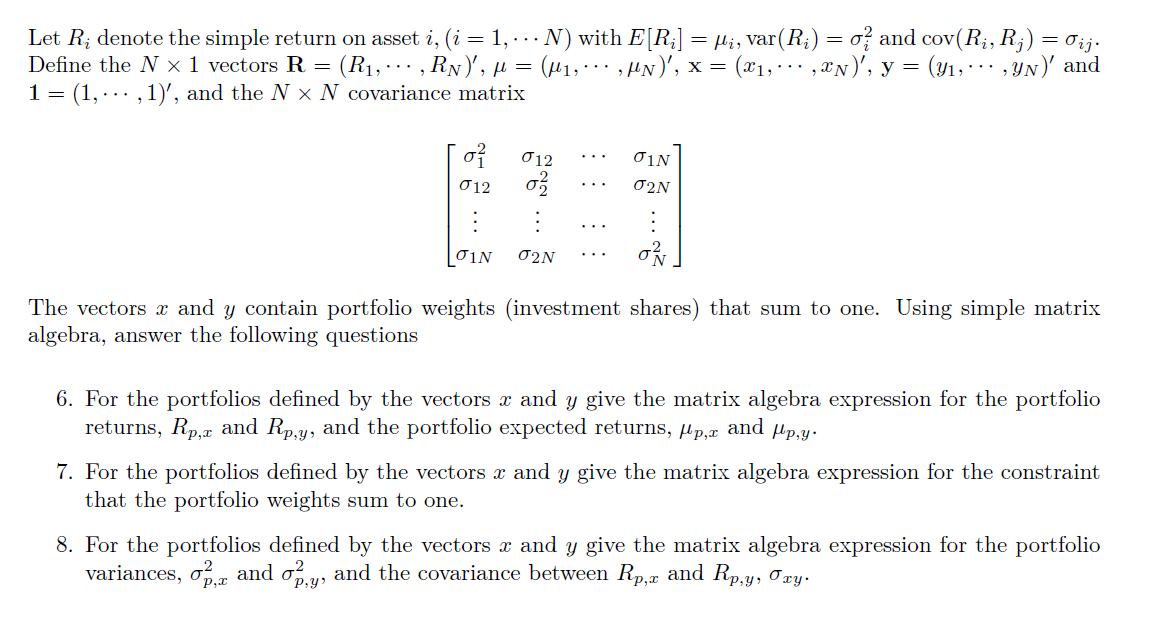

Let Ri denote the simple return on asset i, (i = 1, .-. N) with E[R;] = Hi, var(R;) = 0; and cov(R, R;) = 0ij. Define the N x1 vectors R = (R1, ... , RN)', u = (41, ... ,UN)', x= = (x1, . , XN)', y = (41, . , Yn) and 1 = (1, ... ,1)', and the N ~ N covariance matrix o 01N 012 02N 012 o : 2N 01N o The vectors x and y contain portfolio weights (investment shares) that sum to one. Using simple matrix algebra, answer the following questions 6. For the portfolios defined by the vectors x and y give the matrix algebra expression for the portfolio returns, Rp,z and Rpy, and the portfolio expected returns, fp,x and Mpy: 7. For the portfolios defined by the vectors x and y give the matrix algebra expression for the constraint that the portfolio weights sum to one. 8. For the portfolios defined by the vectors x and y give the matrix algebra expression for the portfolio variances, op,z and op.y, and the covariance between Rp,x and Rp,y, Oxy. Let Ri denote the simple return on asset i, (i = 1, .-. N) with E[R;] = Hi, var(R;) = 0; and cov(R, R;) = 0ij. Define the N x1 vectors R = (R1, ... , RN)', u = (41, ... ,UN)', x= = (x1, . , XN)', y = (41, . , Yn) and 1 = (1, ... ,1)', and the N ~ N covariance matrix o 01N 012 02N 012 o : 2N 01N o The vectors x and y contain portfolio weights (investment shares) that sum to one. Using simple matrix algebra, answer the following questions 6. For the portfolios defined by the vectors x and y give the matrix algebra expression for the portfolio returns, Rp,z and Rpy, and the portfolio expected returns, fp,x and Mpy: 7. For the portfolios defined by the vectors x and y give the matrix algebra expression for the constraint that the portfolio weights sum to one. 8. For the portfolios defined by the vectors x and y give the matrix algebra expression for the portfolio variances, op,z and op.y, and the covariance between Rp,x and Rp,y, Oxy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts