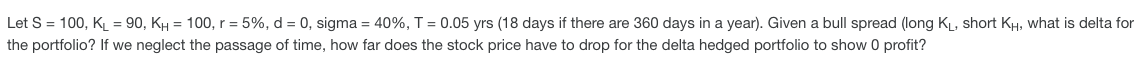

Question: Let S = 100, KL = 90, K4 = 100, r = 5%, d = 0, sigma = 40%, T = 0.05 yrs (18 days

Let S = 100, KL = 90, K4 = 100, r = 5%, d = 0, sigma = 40%, T = 0.05 yrs (18 days if there are 360 days in a year). Given a bull spread (long KL, short Kw, what is delta for the portfolio? If we neglect the passage of time, how far does the stock price have to drop for the delta hedged portfolio to show 0 profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts