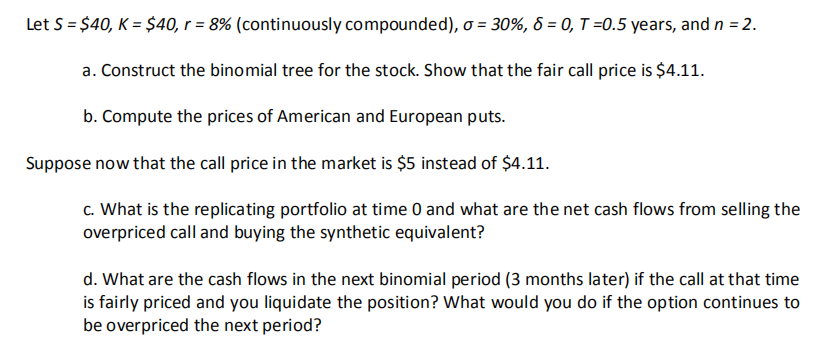

Question: Let S = $40, K = $40, r = 8% (continuously compounded), o = 30%, 8 = 0, T =0.5 years, and n = 2.

Let S = $40, K = $40, r = 8% (continuously compounded), o = 30%, 8 = 0, T =0.5 years, and n = 2. a. Construct the binomial tree for the stock. Show that the fair call price is $4.11. b. Compute the prices of American and European puts. Suppose now that the call price in the market is $5 instead of $4.11. c. What is the replicating portfolio at time 0 and what are the net cash flows from selling the overpriced call and buying the synthetic equivalent? d. What are the cash flows in the next binomial period (3 months later) if the call at that time is fairly priced and you liquidate the position? What would you do if the option continues to be overpriced the next period? Let S = $40, K = $40, r = 8% (continuously compounded), o = 30%, 8 = 0, T =0.5 years, and n = 2. a. Construct the binomial tree for the stock. Show that the fair call price is $4.11. b. Compute the prices of American and European puts. Suppose now that the call price in the market is $5 instead of $4.11. c. What is the replicating portfolio at time 0 and what are the net cash flows from selling the overpriced call and buying the synthetic equivalent? d. What are the cash flows in the next binomial period (3 months later) if the call at that time is fairly priced and you liquidate the position? What would you do if the option continues to be overpriced the next period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts