Question: Let the risk returns values are: Stock fund = 10% Bond fund = 5% Standard deviation Stock fund = 15% Bond fund =9% Coefficient

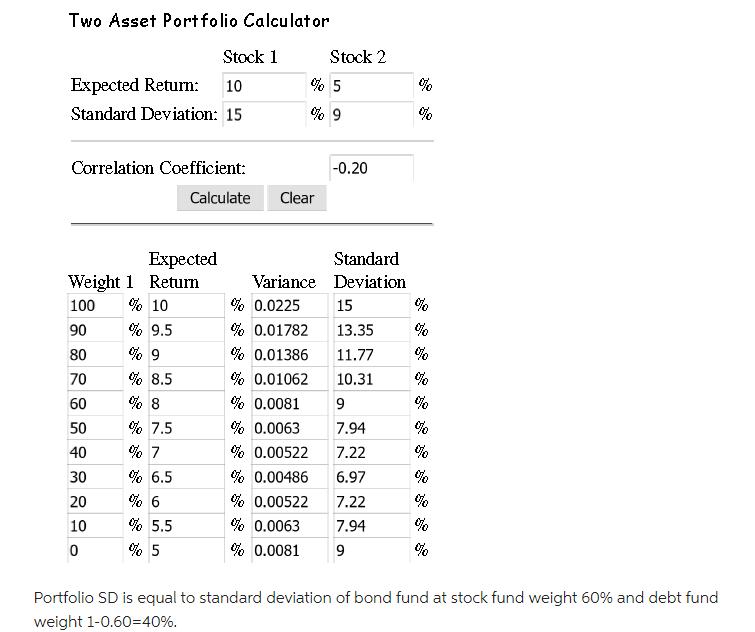

Let the risk returns values are: Stock fund = 10% Bond fund = 5% Standard deviation Stock fund = 15% Bond fund =9% Coefficient of correlation r = -0.20 Values calculated by Zenith wealth are: Two Asset Portfolio Calculator Stock 1 Expected Return: 10 Standard Deviation: 15 Correlation Coefficient: Calculate Weight 1 Return 100 % 10 % 9.5 % 9 % 8.5 % 8 % 7.5 % 7 % 6.5 % 6 %% 5.5 % 5 90 80 Expected 70 60 50 40 30 20 10 0 % 5 % 9 Clear Stock 2 Variance -0.20 Standard Deviation % 0.0225 % 0.01782 % 0.01386 % 0.01062 % 0.0081 % 0.0063 % 0.00522 % 0.00486 % 0.00522 % 0.0063 % 0.0081 9 15 13.35 11.77 10.31 9 7.94 7.22 6.97 7.22 7.94 % %% % Portfolio SD is equal to standard deviation of bond fund at stock fund weight 60% and debt fund weight 1-0.60=40%. The questions on the above scenario are? 4. The results show that a portfolio of both funds will have a standard deviation (?) equal to that of the bond fund alone but a higher return. What are the portfolio weights and expected return of this portfolio?

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts