Question: Let the three-step binary price model with the time step t=1/52 (one week) have the structure shown in Fig. 13.1. Suppose the continuously compounded interest

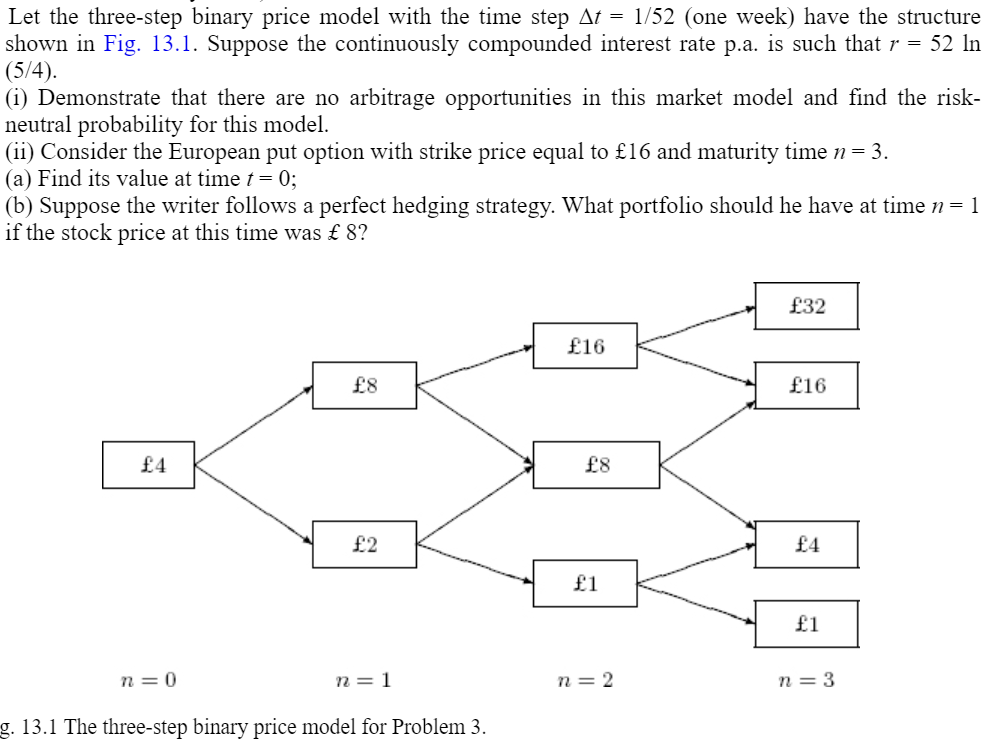

Let the three-step binary price model with the time step t=1/52 (one week) have the structure shown in Fig. 13.1. Suppose the continuously compounded interest rate p.a. is such that r=52ln (5/4) (i) Demonstrate that there are no arbitrage opportunities in this market model and find the riskneutral probability for this model. (ii) Consider the European put option with strike price equal to 16 and maturity time n=3. (a) Find its value at time t=0; (b) Suppose the writer follows a perfect hedging strategy. What portfolio should he have at time n=1 if the stock price at this time was 8 ? g. 13.1 The three-step binary price model for Problem 3 . Let the three-step binary price model with the time step t=1/52 (one week) have the structure shown in Fig. 13.1. Suppose the continuously compounded interest rate p.a. is such that r=52ln (5/4) (i) Demonstrate that there are no arbitrage opportunities in this market model and find the riskneutral probability for this model. (ii) Consider the European put option with strike price equal to 16 and maturity time n=3. (a) Find its value at time t=0; (b) Suppose the writer follows a perfect hedging strategy. What portfolio should he have at time n=1 if the stock price at this time was 8 ? g. 13.1 The three-step binary price model for Problem 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts