Question: (*) Let us consider a put contract with a strike price of $40 and an expiration date in 3 months. The price of the contract

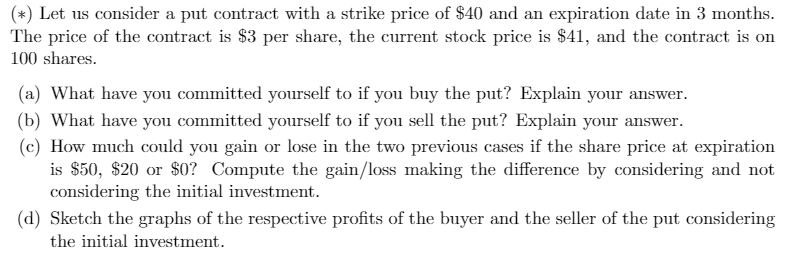

(*) Let us consider a put contract with a strike price of $40 and an expiration date in 3 months. The price of the contract is $3 per share, the current stock price is $41, and the contract is on 100 shares. (a) What have you committed yourself to if you buy the put? Explain your answer. (b) What have you committed yourself to if you sell the put? Explain your answer. (C) How much could you gain or lose in the two previous cases if the share price at expiration is $50, $20 or $0? Compute the gain/loss making the difference by considering and not considering the initial investment. (d) Sketch the graphs of the respective profits of the buyer and the seller of the put considering the initial investment. (*) Let us consider a put contract with a strike price of $40 and an expiration date in 3 months. The price of the contract is $3 per share, the current stock price is $41, and the contract is on 100 shares. (a) What have you committed yourself to if you buy the put? Explain your answer. (b) What have you committed yourself to if you sell the put? Explain your answer. (C) How much could you gain or lose in the two previous cases if the share price at expiration is $50, $20 or $0? Compute the gain/loss making the difference by considering and not considering the initial investment. (d) Sketch the graphs of the respective profits of the buyer and the seller of the put considering the initial investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts