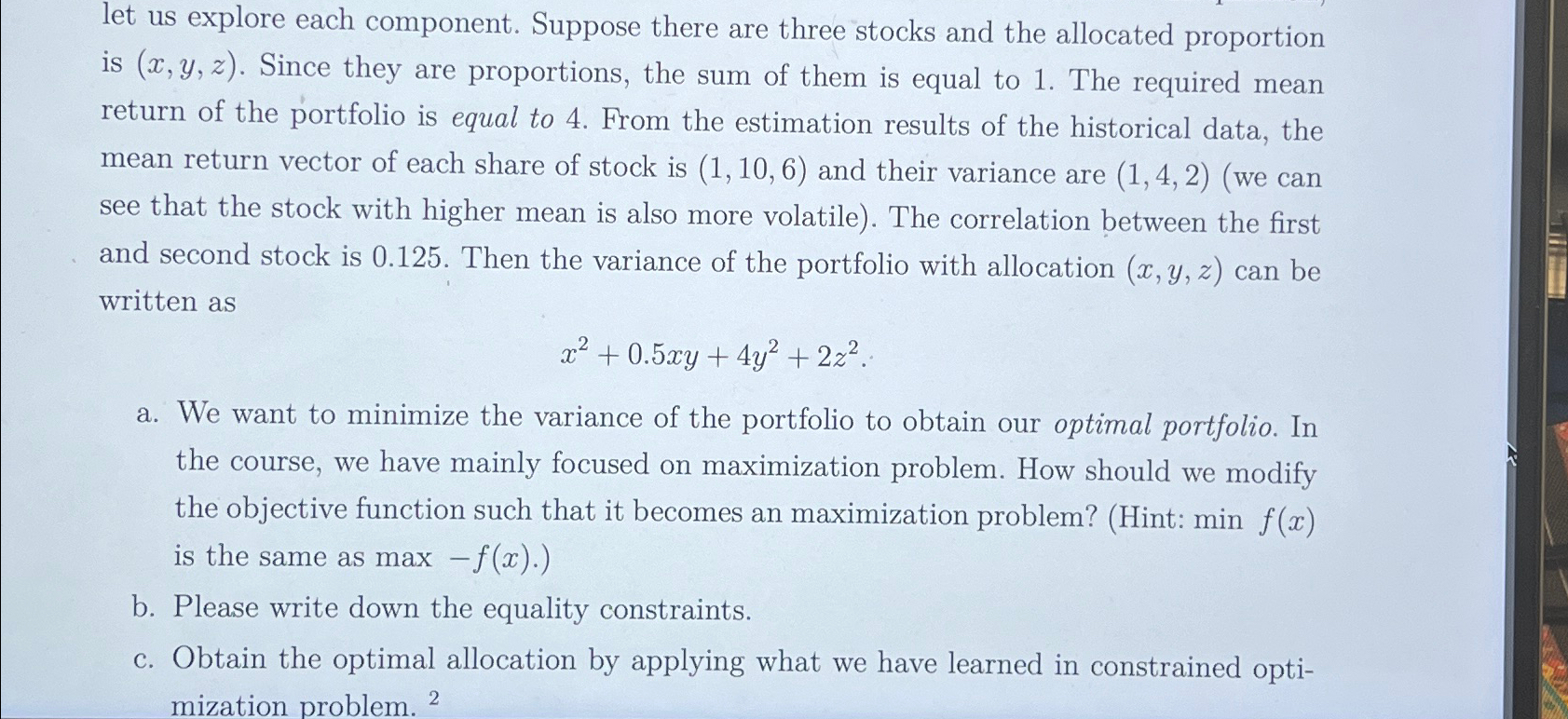

Question: let us explore each component. Suppose there are three stocks and the allocated proportion is ( x , y , z ) . Since they

let us explore each component. Suppose there are three stocks and the allocated proportion is Since they are proportions, the sum of them is equal to The required mean return of the portfolio is equal to From the estimation results of the historical data, the mean return vector of each share of stock is and their variance are we can see that the stock with higher mean is also more volatile The correlation between the first and second stock is Then the variance of the portfolio with allocation can be written as

a We want to minimize the variance of the portfolio to obtain our optimal portfolio. In the course, we have mainly focused on maximization problem. How should we modify the objective function such that it becomes an maximization problem? Hint: minf is the same as max

b Please write down the equality constraints.

c Obtain the optimal allocation by applying what we have learned in constrained optimization problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock