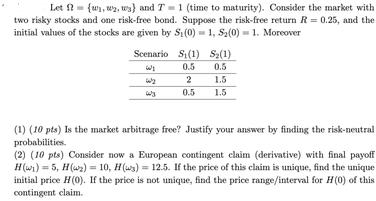

Question: Let (w, 2, ws) and 7 = 1 (time to maturity). Consider the market with two risky stocks and one risk-free bond. Suppose the

Let (w, 2, ws) and 7 = 1 (time to maturity). Consider the market with two risky stocks and one risk-free bond. Suppose the risk-free return R = 0.25, and the initial values of the stocks are given by S (0) 1, S(0) 1. Moreover Scenario 602 wy S(1) 0.5 2 0.5 S(1) 0.5 1.5 1.5 (1) (10 pts) Is the market arbitrage free? Justify your answer by finding the risk-neutral probabilities. (2) (10 pts) Consider now a European contingent claim (derivative) with final payoff H()=5, H() = 10, H(s) = 12.5. If the price of this claim is unique, find the unique initial price H(0). If the price is not unique, find the price range/interval for H(0) of this contingent claim.

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

To determine if the market is arbitragefree and find the riskneutral probabilities we can use the co... View full answer

Get step-by-step solutions from verified subject matter experts