Question: Let x be a random variable which denotes the possible monetary loss on a portfolio over a fixed time horizon T ( e . g

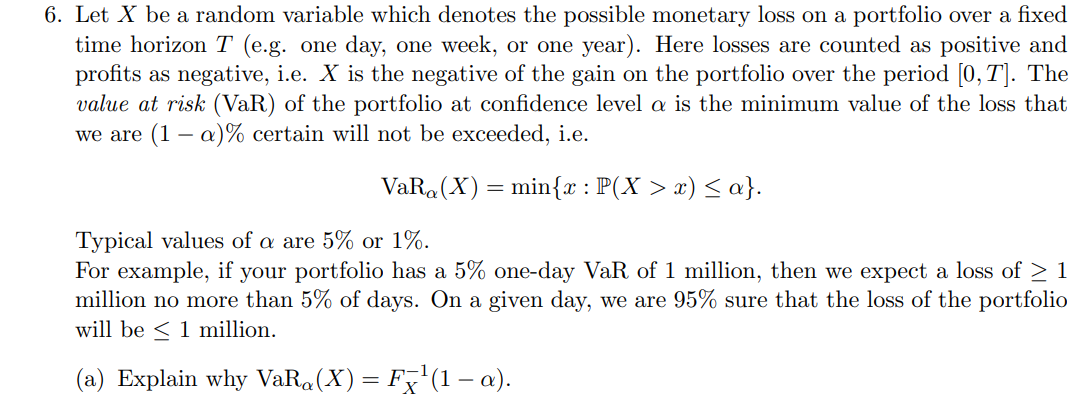

Let be a random variable which denotes the possible monetary loss on a portfolio over a fixed

time horizon eg one day, one week, or one year Here losses are counted as positive and

profits as negative, ie is the negative of the gain on the portfolio over the period The

value at risk VaR of the portfolio at confidence level is the minimum value of the loss that

we are certain will not be exceeded, ie

min:

Typical values of are or

For example, if your portfolio has a oneday VaR of million, then we expect a loss of

million no more than of days. On a given day, we are sure that the loss of the portfolio

will be million.

a Explain why

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock