Question: Let z(k) denote the k-year continuously compounded zero-coupon yield for the current term structure. You are given that z(1) = 0.035, z(2) = 0.041,

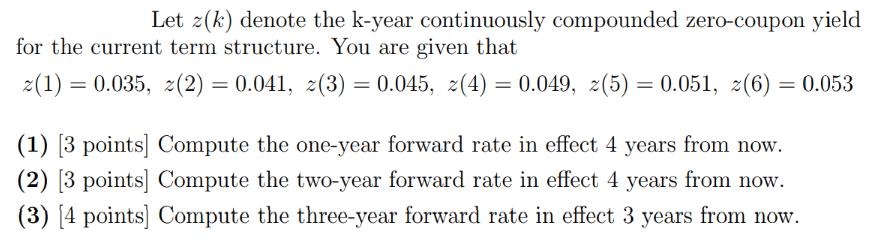

Let z(k) denote the k-year continuously compounded zero-coupon yield for the current term structure. You are given that z(1) = 0.035, z(2) = 0.041, z(3) = 0.045, z(4) = 0.049, z(5) = 0.051, z(6) = 0.053 (1) [3 points] Compute the one-year forward rate in effect 4 years from now. (2) [3 points] Compute the two-year forward rate in effect 4 years from now. (3) [4 points] Compute the three-year forward rate in effect 3 years from now.

Step by Step Solution

There are 3 Steps involved in it

To compute the forward rates we can use the formula Ft1 t2 frac1 zt2ightt2 frac1 zt1ightt1 1 where F... View full answer

Get step-by-step solutions from verified subject matter experts