Question: Let's calculate Judy has $2,000 for a down payment on a vehicle and she can afford monthly payments of $400. She wants to finance a

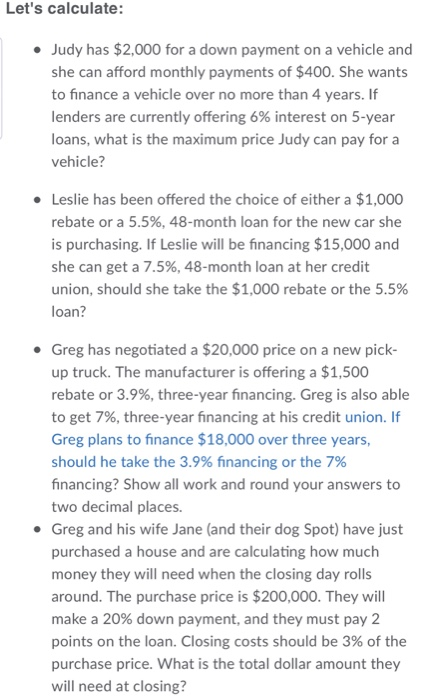

Let's calculate Judy has $2,000 for a down payment on a vehicle and she can afford monthly payments of $400. She wants to finance a vehicle over no more than 4 years. If lenders are currently offering 6% interest on 5-year loans, what is the maximum price Judy can pay for a vehicle? Leslie has been offered the choice of either a $1,000 rebate or a 5.5%, 48-month loan for the new car she is purchasing. If Leslie will be financing $15,000 and she can get a 7.5%, 48-month loan at her credit union, should she take the $1,000 rebate or the 5.5% loan? e Greg has negotiated a $20,000 price on a new pick- up truck. The manufacturer is offering a $1,500 rebate or 3.9%, three-year financing. Greg is also able to get 7%, three-year financing at his credit union. If Greg plans to finance $18,000 over three years, should he take the 3.9% financing or the 7% financing? Show all work and round your answers to two decimal places. e Greg and his wife Jane (and their dog Spot) have just purchased a house and are calculating how much money they will need when the closing day rolls around. The purchase price is $200,000. They will make a 20% down payment, and they must pay 2 points on the loan. Closing costs should be 3% of the purchase price. What is the total dollar amount they will need at closing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts