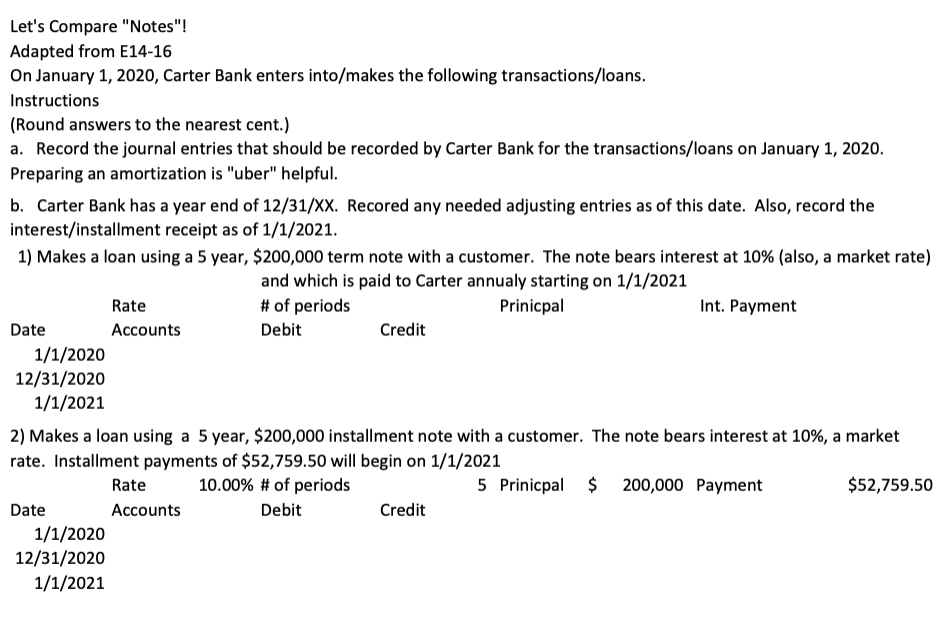

Question: Let's Compare Notes! Adapted from E14-16 On January 1, 2020, Carter Bank enters into/makes the following transactions/loans. Instructions (Round answers to the nearest cent.) a.

Let's Compare "Notes"! Adapted from E14-16 On January 1, 2020, Carter Bank enters into/makes the following transactions/loans. Instructions (Round answers to the nearest cent.) a. Record the journal entries that should be recorded by Carter Bank for the transactions/loans on January 1, 2020. Preparing an amortization is "uber" helpful. b. Carter Bank has a year end of 12/31/XX. Recored any needed adjusting entries as of this date. Also, record the interest/installment receipt as of 1/1/2021. 1) Makes a loan using a 5 year, $200,000 term note with a customer. The note bears interest at 10% (also, a market rate) and which is paid to Carter annualy starting on 1/1/2021 Rate # of periods Prinicpal Int. Payment Date Accounts Debit Credit 1/1/2020 12/31/2020 1/1/2021 2) Makes a loan using a 5 year, $200,000 installment note with a customer. The note bears interest at 10%, a market rate. Installment payments of $52,759.50 will begin on 1/1/2021 Rate 10.00% # of periods 5 Prinicpal $ 200,000 Payment $52,759.50 Date Accounts Debit Credit 1/1/2020 12/31/2020 1/1/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts